5 Things You Need to Know About Big Box Logistics In Q4 2023

Take-up reaches 24.8 million sq ft in 2023 – 2% ahead of long run pre-Covid average

DTRE Big Box Vacancy rate moves higher to 6.85%

Annual Rental Growth to end December reaches 7.2%

All Industrial & Logistics investment volumes reached £7.4bn in 2023

Macro themes will dominate again in 2024 – inflation & interest rates – but macro picture will improve as we progress through the year

Occupational

After three record breaking years, the UK’s Big Box occupational market has reverted to pre-pandemic levels, however, given the macro-economic picture that unfolded during 2023 that is not necessarily such a surprise.

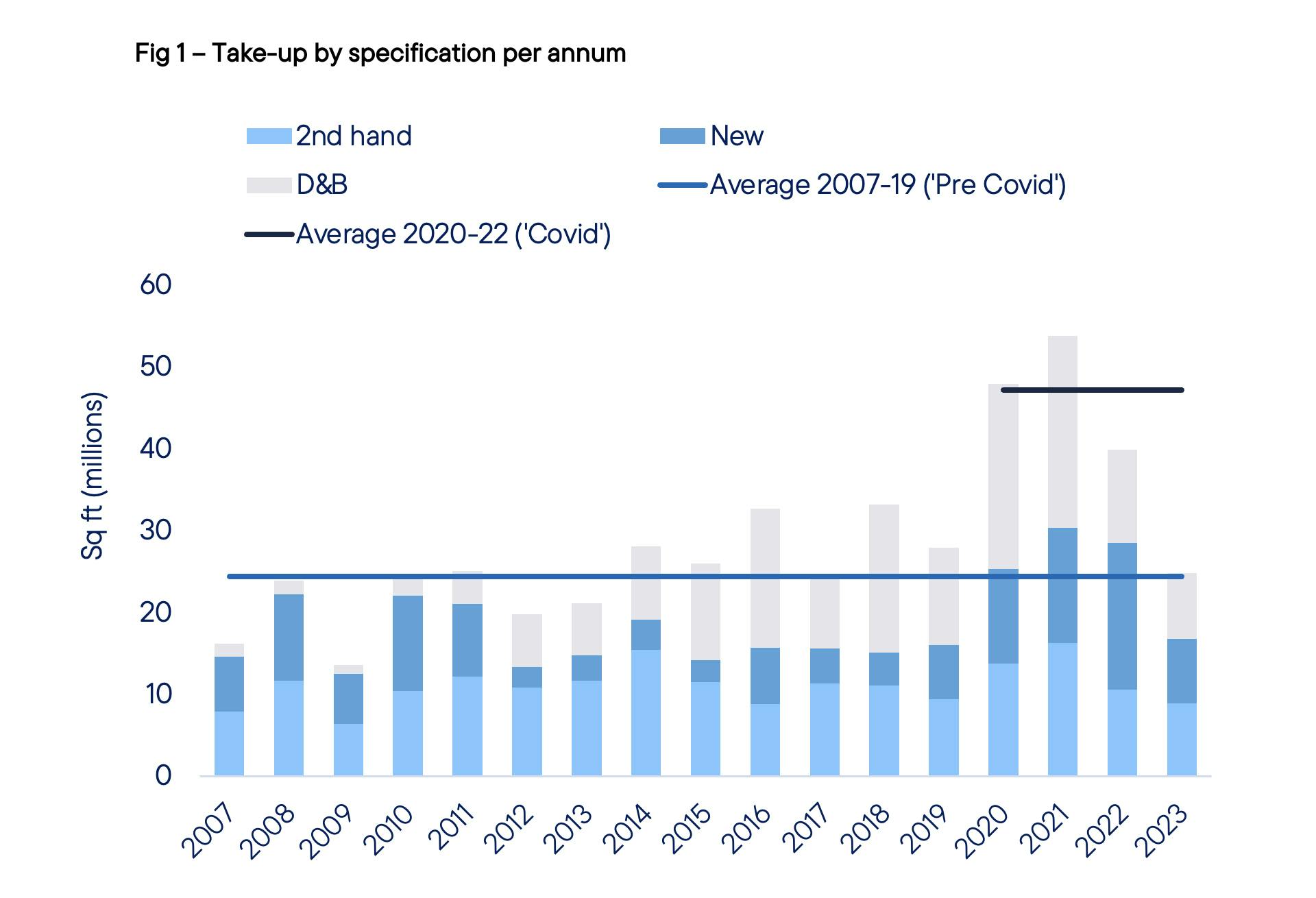

Take up by the end of 2023 was just short of 25 million sq ft and whilst that is down 35% year-on-year, when compared to the long-run ‘pre-Covid’ average from 2007-19, take-up for 2023 is actually up 2%. Perhaps more importantly, DTRE are tracking 8.2 million sq ft that is currently under offer as we start 2024, which will provide a significant boost to take-up volumes.

The most dominant sector in Q4’23 (and in 2023 as a whole) remained the retailers, who accounted for just over 51% of total occupier demand in the final three months of the year, with Amazon’s return to the market, securing a site at SEGRO’s Northampton Gateway to develop a new 2 million sq ft facility – an early Christmas present for the market.

Looking ahead, we expect the retailers to continue that trend as the dominant sector. The grocers, including Tesco, Sainsbury’s and Marks & Spencer all have requirements as part of a drive to increase supply chain efficiency, and we expect Amazon are on the cusp of a significant return in 2024.

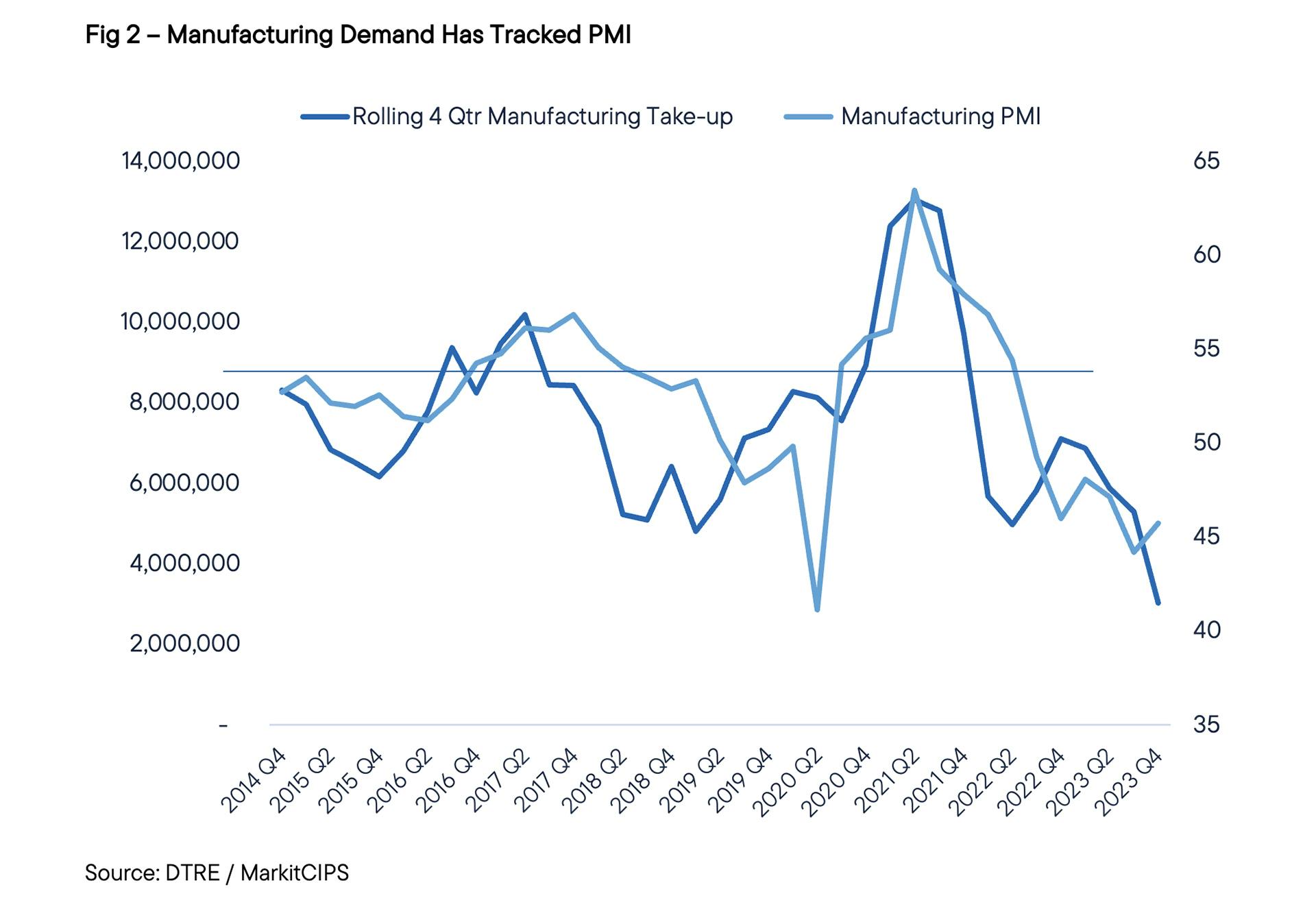

Whilst manufacturing enjoyed a strong Q3 last year, that uptick was not sustained in Q4, with just five transactions totaling 600,000 sq ft. Given the latest PMI and GDP numbers from the manufacturing sector, we would be a surprised to see above trend demand from that area of the market in 2024 (see Fig 2).

Turning to supply and vacancy, the supply of Big Boxes has continued to rise throughout the year, with 15 million sq ft (64 buildings) of new speculative developments completing across the UK together with a further 8 million sq ft of ‘grey space’ added to the supply schedules. The effect is that the DTRE Big Box Vacancy Rate has risen all the way to 6.85% by end 2023, up from just 3.5% twelve months ago.

The statistic is that 36% of the UK’s entire Grade A supply (in 24 buildings) is of between 300,000 and 400,000 sq ft.

However, on a positive note, last year’s pricing correction and construction price rises have ensured no supply increase, and so we anticipate that the current vacancy rate of 6.85% will be the peak of supply, with only 5.7 million sq ft of new speculative development is due to complete in 2024.

This will be the lowest level of new speculative completions of Big Boxes since 2017. Available planning permissions and prohibitive site enablement costs will ensure that on-site starts will remain suppressed.

"There is currently 23 million sq ft of Grade A space on the market, however, with 24 assets totalling 36% of the UK’s entire Grade A supply is between 300,000 and 400,000 sq ft, it is evident that certain size brackets have more vacancy than others."

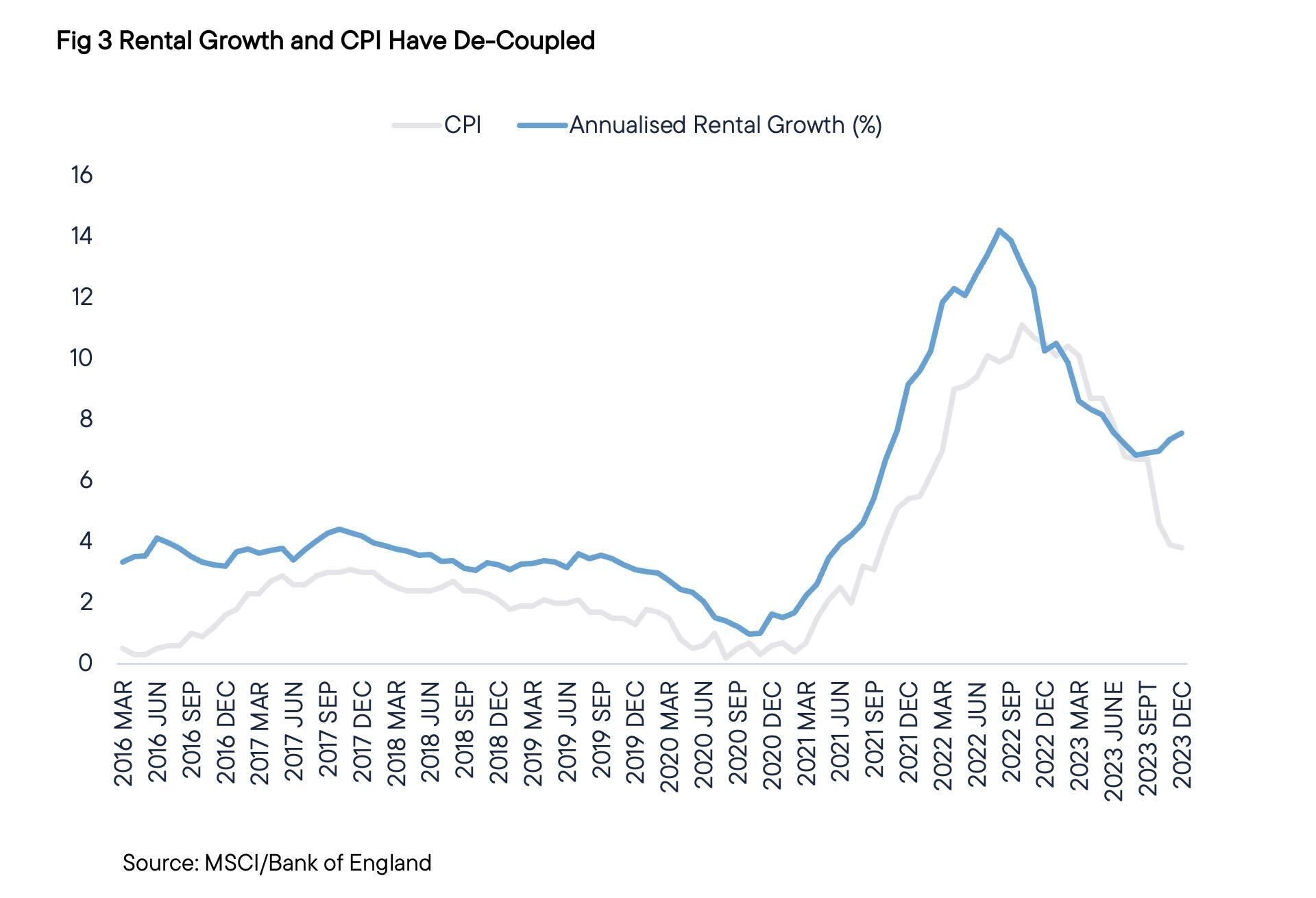

Finally, rental growth continues to confound. The latest MSCI Monthly Index for end December showed annualized rental growth of 7.2% for distribution warehouses. Whilst rental growth had tracked closely with the UK’s CPI for much of 2023, by autumn a de-coupling process had started and we are now seeing real rental growth of 330 basis points over the latest inflation number of 3.9% (see Fig 3).

Investment

Macro-economic themes dominated the investment market in 2023 and those same themes won’t disappear entirely over the next 12 months. However, whilst downside risks remain, long term trends (de-globalisation, demographics, and de-carbonisation) also provide tailwinds for the logistics sector and with the overall macro outlook starting to improve, with inflation easing, a UK recession looking unlikely and with the interest rates narrative switching to cuts rather than rises, sentiment turned to a more positive outlook as ‘23 closed and ’24 opened for business.

Investment volumes across all industrial and logistics reached £7.4bn in 2023, and though that was down on the £13.3bn transacted in 2022, it is still a remarkable 40% ahead of the average annual volume from 2007-2019. When stripping out multi-let deals, overall logistics volumes reached £4.7bn, down 39.7% on 2022.

Despite overall volumes being ahead of the long-run average, Q4’23 finished as a damp squib, with just shy of £530m transacted, with the largest single-let deal being the sale by Tritax of an 847,000 sq ft Eddie Stobart unit on midlands Logistics Park to P3 Logistics Park for c.£92m.

Looking ahead to what’s in store in 2024, the industrial and logistics sector remains the asset class of choice and whilst fully acknowledging that some investors will come under pressure from numerous external forces, such as fund redemptions, refinancing and potential breaches in Loan-to-Value covenants, we do not expect to see distress in the market.

The lack of distress can be largely attributed to the fact that many banks are now reluctant to step back into the market having worked out of their positions following the GFC. As a result, investors faced with having to refinance could be given the option to simply ‘kick the can’ down the road in the hope that improving macro-fundamentals will see an easing in financing conditions and/or some yield compression.

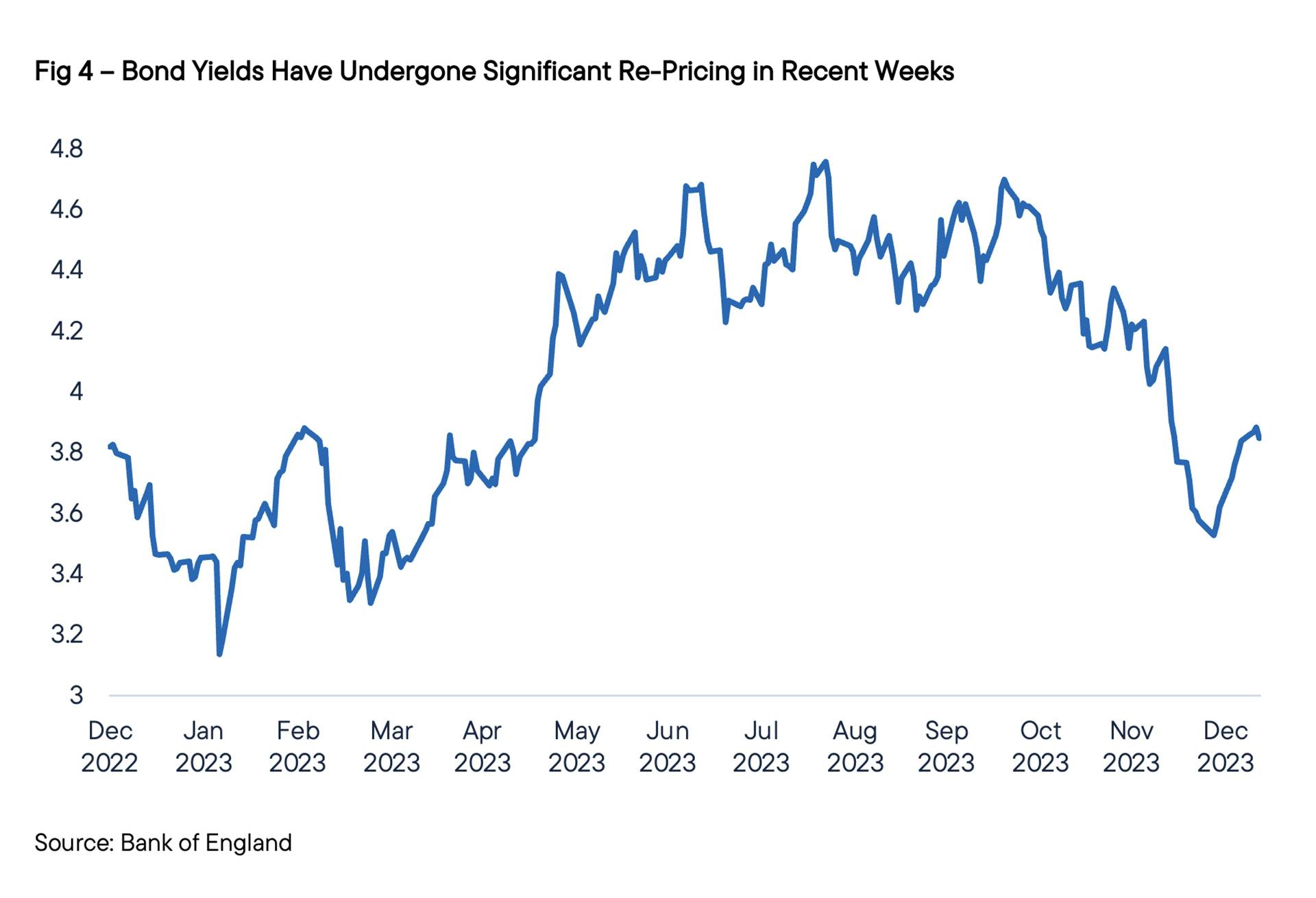

In terms of pricing, the economic fundamentals have improved in recent weeks, with the yield on UK-10 year gilts coming in from c.4.7% at the end of October 2023, to 3.4% by the turn of the year. Albeit that yield has moved out once more in the first two weeks of January 2024 to stand at 3.9% (January 18th 2024).

The reason for the fall in yields in recent weeks has been that the US Federal Reserve policy makers signaled in mid-December that they expect to undertake 75 basis points of cuts this year, marking an abrupt shift from previous warnings that rates could still go higher through much of 2024.

Whilst the rhetoric from the Bank of England has remained that it’s ‘too early to signal rate cuts’ and that the fight against inflation is not yet over, the BoE is largely expected to follow the US FED in cutting rates in 2024. Therefore, from late summer, DTRE expect to see more conviction from investors as inflation and in-turn the Bank of England base rate starts to fall. As a result, UK-10 year gilt yields should also fall to c.3.5% and stabilise at that level, allowing prime yields to fall in-line with the ‘risk-free’ rate.

In terms of who will be active market participants in 2024, institutions are returning to the market after being priced out for a number of years, seeking to capitalise on the limited number of unexpectedly available core assets.

However, the US Private Equity houses, Prologis and the UK REITs will be the dominant market forces as the year progresses. Blackstone, KKR and Ares, amongst others, have all signaled their intention to deploy into the sector in 2024.

"... from late summer, DTRE expect to see more conviction from investors as inflation and in-turn the Bank of England base rate starts to fall. As a result, UK-10 year gilt yields should also fall to c.3.5% and stabilise at that level, allowing prime yields to fall in-line with the ‘risk-free’ rate."