Total science and technology take-up in Cambridge reached 99,300 sq ft across 14 deals by the end of 2024, comprising of 75,800 sq ft of laboratory space and 23,500 sq ft of mid-tech space. This represents a 65% decline year-on-year from 2023, and a 39% drop compared to the five-year average (2019–2023), as the post-COVID constraints on venture capital investment continued to bite, and affect occupier confidence.

The largest deal of the year involved Welbeck Health Partners, who secured 31,000 sq ft at the Orion Building on Howard Group’s Unity Campus. Another notable transaction was Vianautis taking 10,800 sq ft at Cadence also on the Park, with an additional 8,400 sq ft already exchanging there early in 2025.

At the close of Q4, 57,900 sq ft of laboratory and mid-tech space was under offer, with 20% of these transactions already completing in early 2025.

Turning to supply, the total available up-and-built laboratory space in Cambridge reached 224,400 sq ft by year-end, a 159% increase year-on-year, driven by projects like One Granta, which completed in 2024 and remains largely vacant. Despite a subdued year in take-up, and increased stock coming to market, Cambridge maintained the lowest vacancy rate among the Golden Triangle markets, reflecting its resilience and maturity.

DTRE is tracking 667,500 sq ft of total named demand, with 240,000 sq ft classified as active. By count, 13% of demand was for spaces below 10,000 sq ft, with the majority of requirements falling within the 10,000–30,000 sq ft range and the average requirement size being 26,500 sq ft. This highlights Cambridge’s standing as a mature science and technology market, bolstered by an established scientific ecosystem.

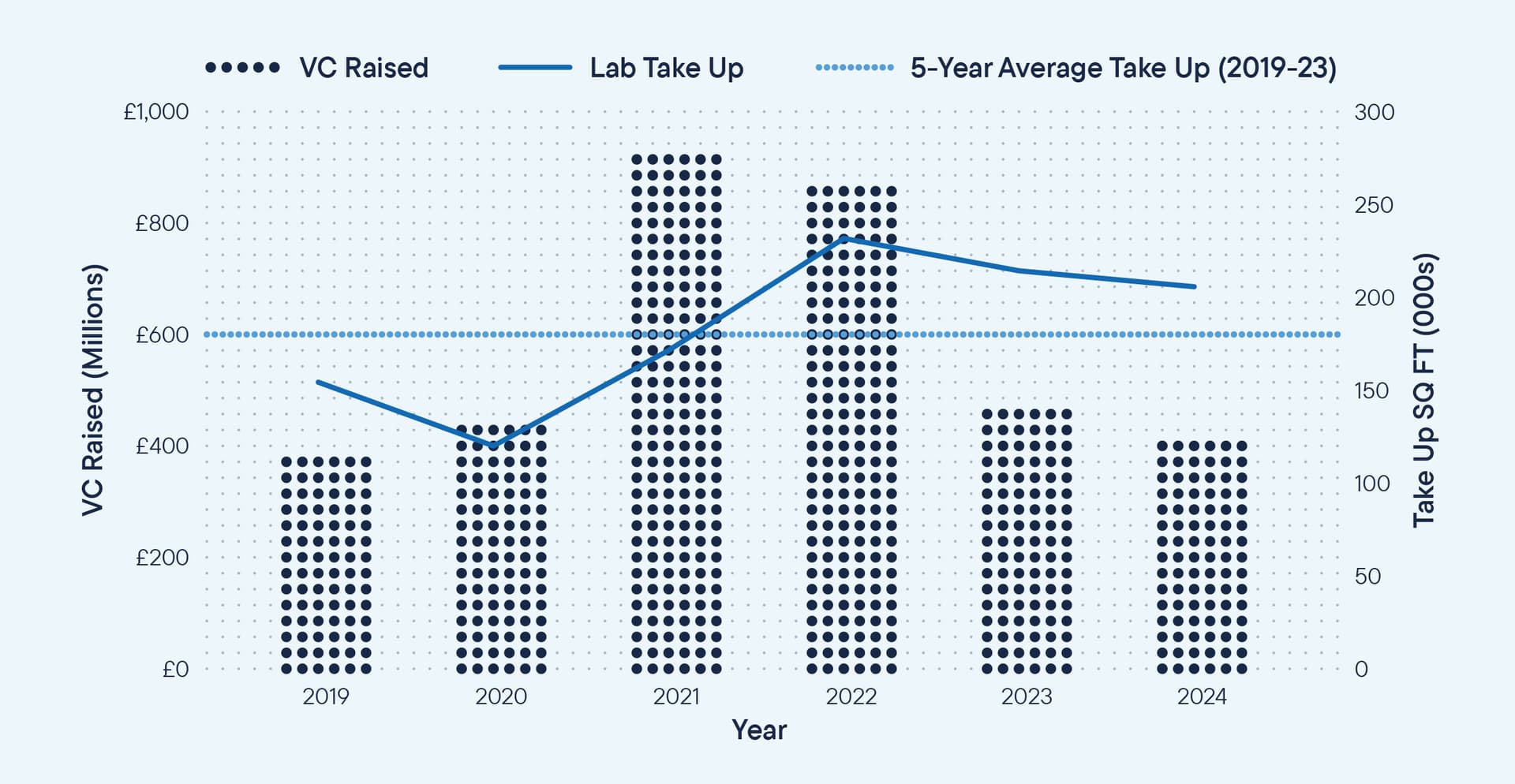

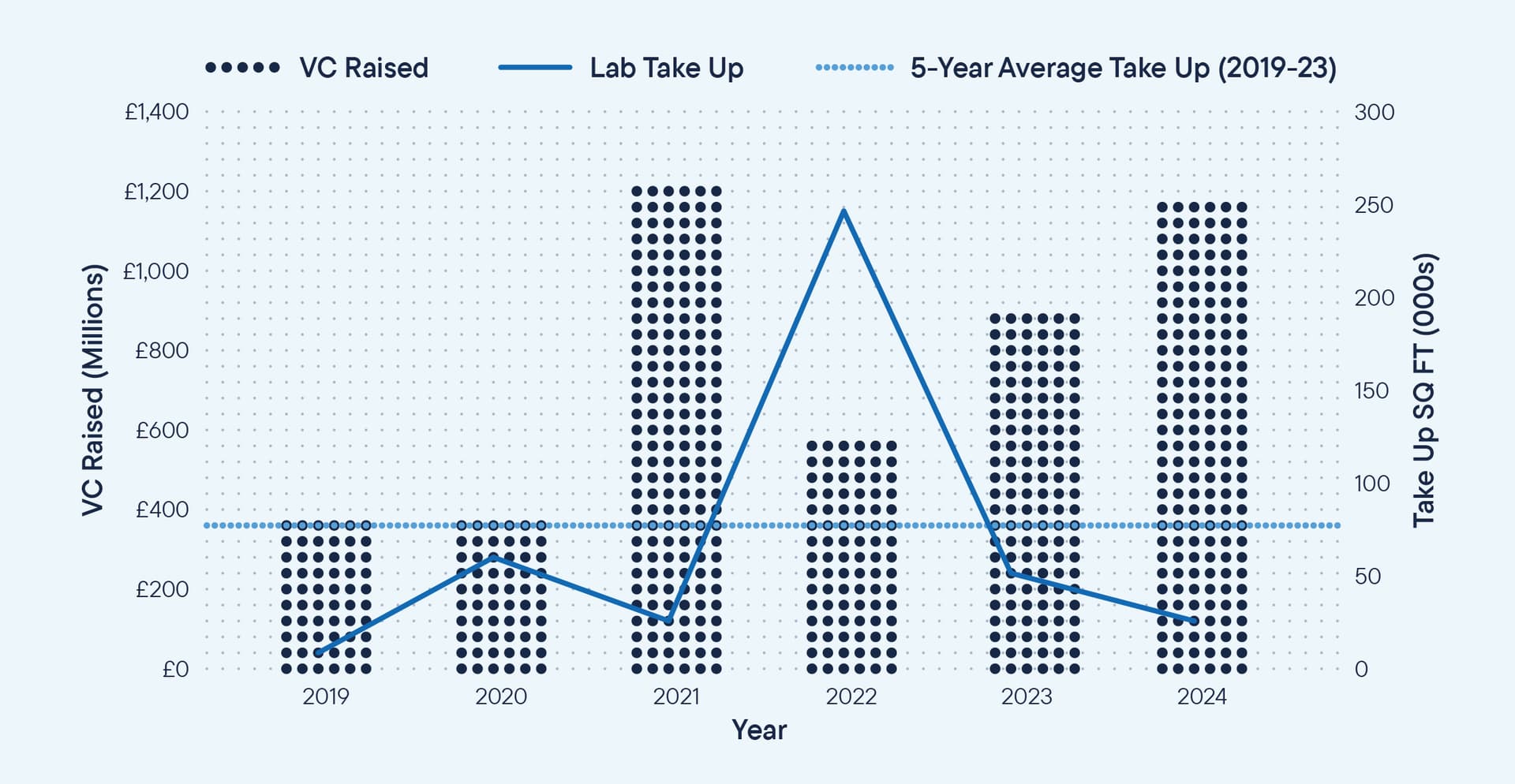

38 life science and biotech firms headquartered in Cambridge raised a total of £610 million in 2024 through 111 fundraisings and grants, reflecting a 15% decrease year-on-year. Despite this, the number of deals increased by 3%, a positive signal of market activity and increased investor confidence.

Laboratory take-up in London reached 30,400 sq ft across 15 deals in 2024, with all transactions for spaces under 5,000 sq ft. The largest wet laboratory lease was Baseimmune’s 3,350 sq ft at LBIC Apex, while 4,900 sq ft of dry lab space was taken by a confidential AI company at Caledonia House.

Although take-up was down 43% year-on-year and 62% below the five-year average (2019–2023), 107,000 sq ft was under offer at year-end, which, if completed in 2025, would exceed the five-year average by 33%.

Total demand for laboratory space reached 403,900 sq ft, with 247,700 sq ft categorised as active demand. Reflecting London’s status as the nascent science market, 63% of demand by count was for spaces below 10,000 sq ft, further segmented as 22% below 2,000 sq ft, 20% between 2,000–5,000 sq ft, and 22% between 5,000–10,000 sq ft.

As of year-end, 223,300 sq ft of laboratory space was available, with the bulk concentrated in the Knowledge Quarter, driven by the first wave of purpose-built labs reaching practical completion. In 2025, a further 1 million sq ft of planned development is set to be delivered within the Knowledge Quarter, including Apex and Reflector at Tribeca, and Pioneer’s Victoria House.

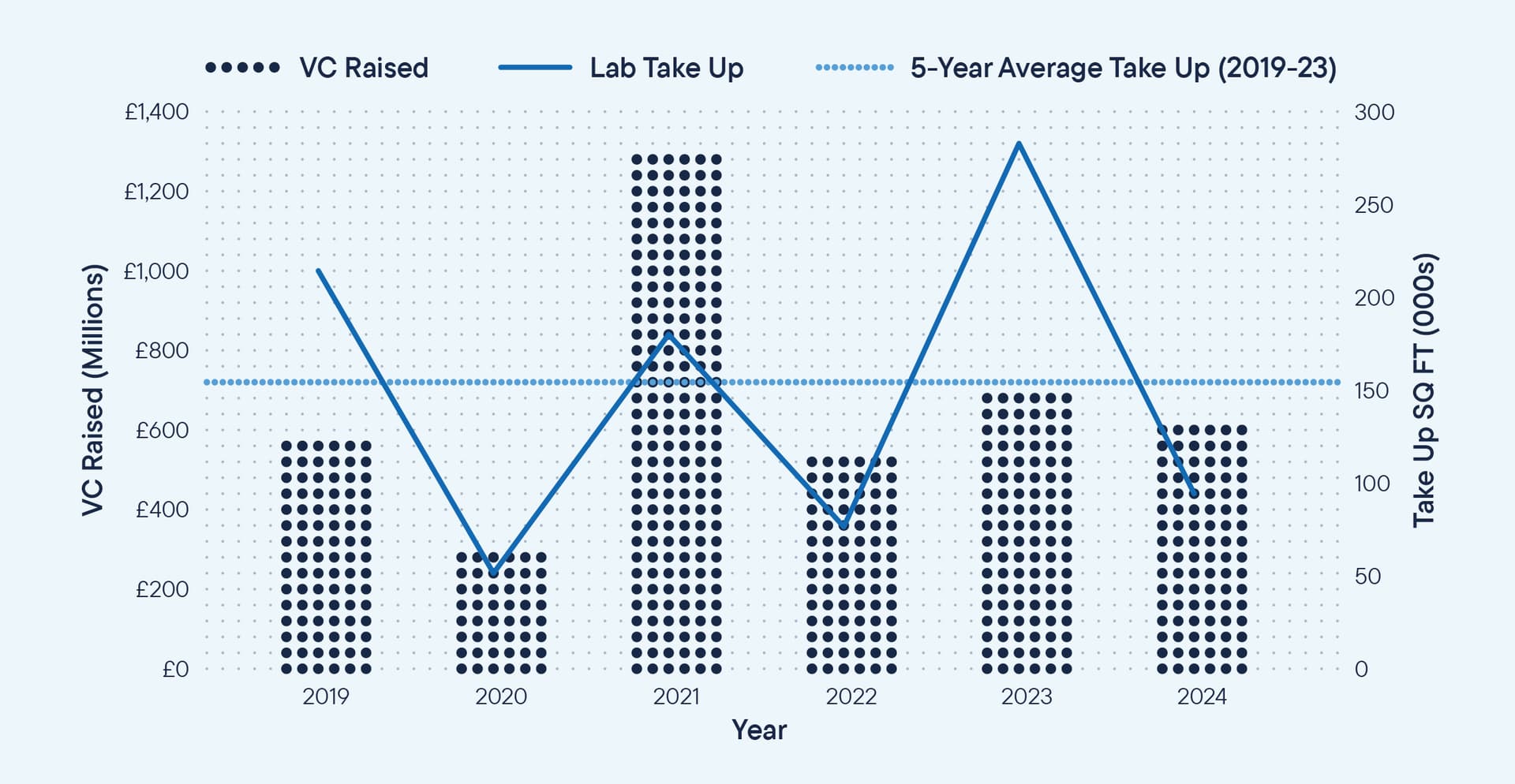

Venture capital into London-based companies reached £1.18 billion in 2024 across 196 fundraisings and grants, accounting for 53% of the Golden Triangle’s total. This figure dramatically surpassed the five-year average (2019–2023) of £694 million and was the second best year on record, just 3.7% down on the COVID peak. With 72% of funding raised in the latter half of the year, we expect this momentum to carry forward into 2025 and revitalise on-hold demand for laboratory space.

Oxford led the Golden Triangle for laboratory take-up in 2024, with 190,100 sq ft occupied by science and technology firms and an additional 18,200 sq ft of mid-tech space transacted. While this marked a 7% year-on-year decline, it was 12% above the five-year average (2019–2023) of 186,500 sq ft, exceeding my earlier projections by 9%. Furthermore, 53,900 sq ft of laboratory space and 12,000 sq ft of mid-tech space was under offer at year-end, with 25,500 sq ft already transacted in 2025.

The largest deal of the year was Novo Nordisk’s lease of 61,000 sq ft at The Iversen Building on The Oxford Science Park, accounting for 29% of total take-up and ranking as Oxford’s third-largest laboratory deal since 2018, behind the Moderna deal in 2023 and Oxford Biomedica’s HQ lease in 2022.

At the close of 2024, 205,400 sq ft of laboratory space was available, with Building One at Begbroke Science Park contributing 63,900 sq ft to the total.

Demand for laboratory and mid-tech space in Oxford stood at 636,800 sq ft, with 373,000 sq ft categorised as active demand. Smaller units were prevalent, with 59% of active demand for spaces below 10,000 sq ft, while 33% targeted spaces between 10,000–30,000 sq ft. This demand pattern underscores Oxford’s position as the middle child of the Golden Triangle markets, blending relative maturity with growth potential.

Venture capital raised by Oxford-headquartered life science and biotech firms totalled £419 million in 2024, a 12% year-on-year decline. Despite this, Oxford has consistently recorded the lowest five-year average of venture capital raised among Golden Triangle markets (£628 million). Encouragingly, 36% of the total was raised in Q4, signalling a potential resurgence in fundraising activity throughout 2025.