Trump 2.0

Donald Trump won the US Presidential Election and is now set to become just the second man – after Grover Cleveland – to serve two non-consecutive terms as President. Whilst there’s a multitude of various policies Trump ‘might’ enact, from abortion to the Ukraine War, for the purposes of this piece, we will focus on what Trump means for markets, commodities and real estate in the more immediate and medium term and the follow through impact, if any, it will have on the UK.

The Trump ‘Trade’

What is the much talked about ‘Trump Trade’? Trump has promised to ‘end inflation’, cut taxes and interest rates, reduce immigration and put a tariff of 10% to 20% on all imports, a tariff of 60% or more on imports from China, and tariffs of up to 100% on some imports from Mexico.

But how realistic are these goals and will they instead produce higher inflation and higher interest rates?

Whilst tax cuts will boost consumer spending, that will in turn put upward pressure on prices as more money chases the goods and services available, while simultaneously cutting immigration and deporting illegal immigrants will cut the supply of labour and mean that wages in the US push higher. Finally, the introduction of tariffs on imported goods will also increase prices for consumers. All these inflationary measures will mean Jay Powell at the Fed will be unable to increase the cadence of any interest rate cuts.

Equities

Given Trump’s focus on trade tariffs then expect sectors tied to international trade – particularly tech, shipping and consumer goods to experience a degree of volatility. On the other hand, the president-elect’s emphasis on deregulation and corporate tax cuts may well give short-term boosts to industries like traditional energy, financials, and defence. Whilst his chief-supporter, the world’s richest man Elon Musk has seen shares in Tesla shoot up 55% in the last month.

Overall, the evidence suggests that the choice of president has little influence on Wall Street and the focus will instead remain on earnings.

DTRE View

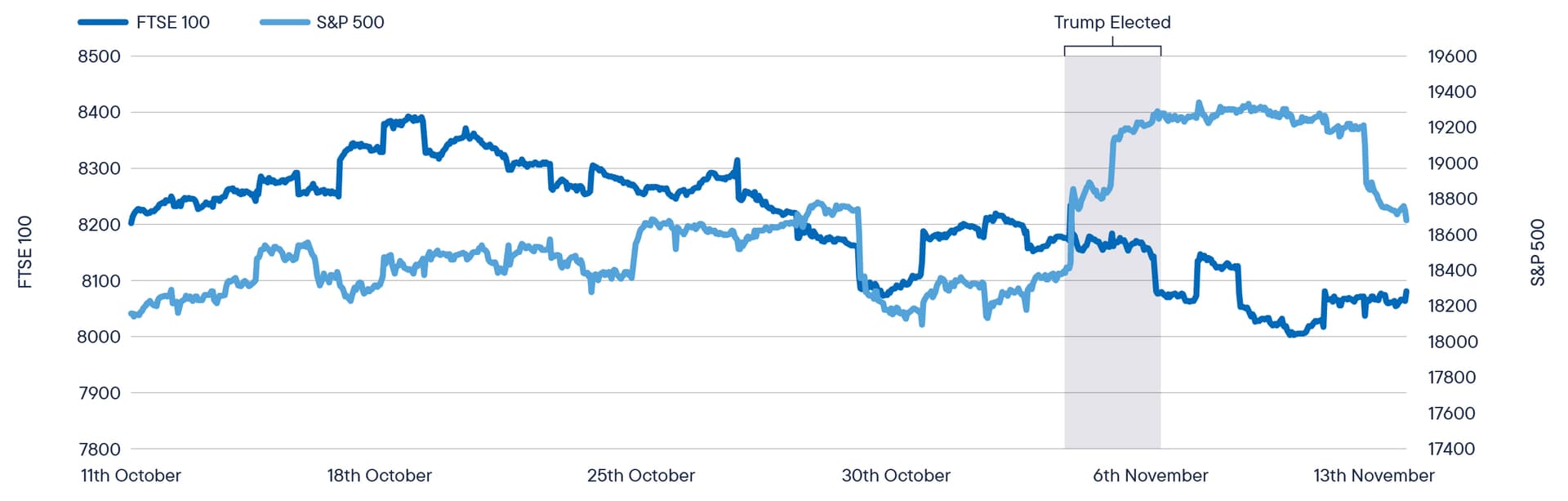

Limited carry across to UK equity markets. The FTSE 100 (- 1.40%) and FTSE 250 (+0.07%) have hardly moved since Trump’s victory. In contrast, the S&P500, the Nasdaq Composite and the Dow Jones are all up north of 2%, having originally risen more than 5%.

Commodities

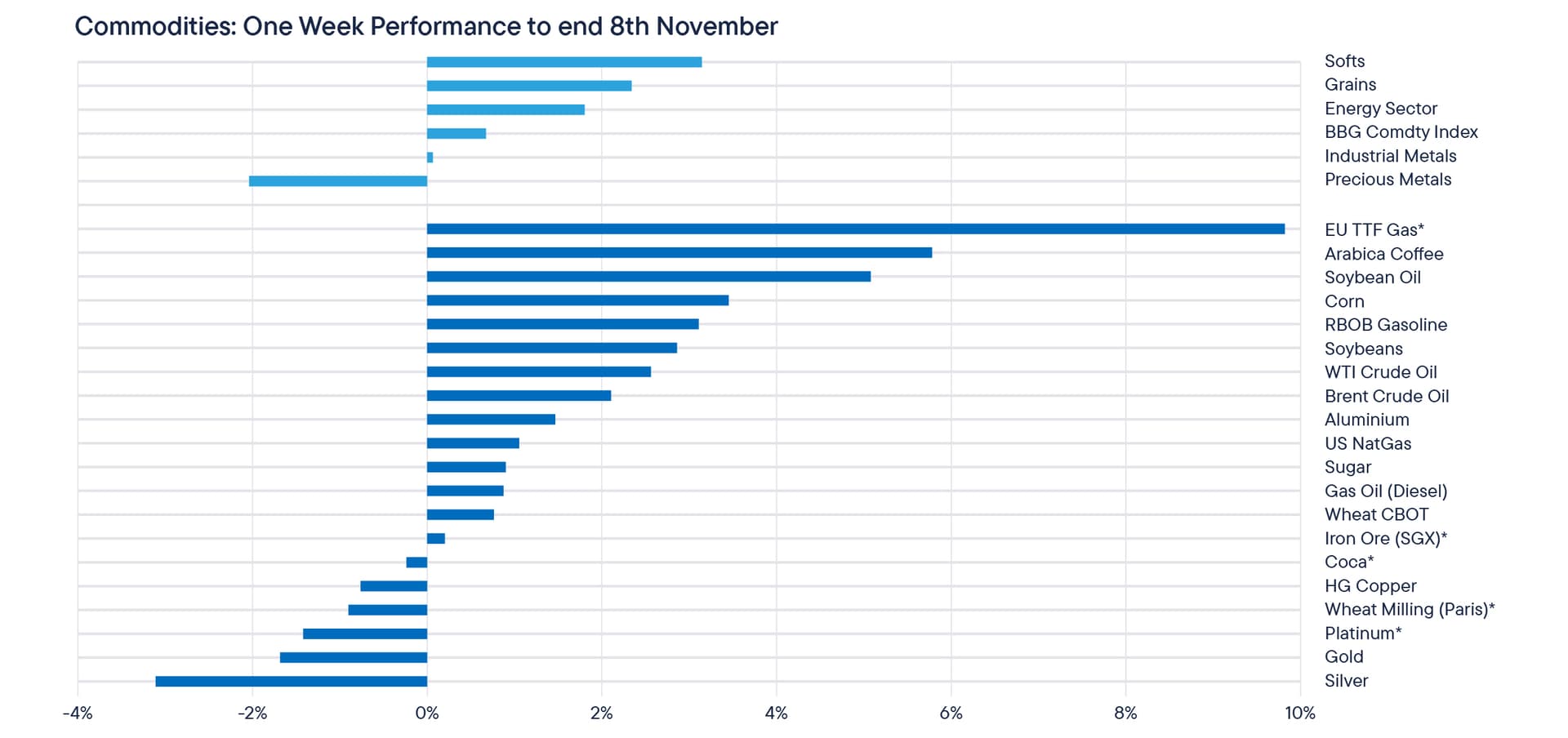

Industrial metals, particularly copper, silver, and iron ore were the major casualties from Trump’s victory with Trump’s proposed trade tariffs being immediately viewed as a negative for the sector.

Whilst tariffs may take months to implement, the commodities sector has been looking to China for additional measures to support its troubled economy. However, hopes for a significant stimulus were dented after a week-long meeting of China’s NPC delivered little in terms of fresh initiatives, leading to further fresh weakness.

Turning to oil, the OPEC+ group of producers may face increased challenges in 2025, not only from Trump’s “drill, baby drill” stance but more importantly from a weak global economic outlook and the energy transition, which is now seeing Chinese demand close to peaking.

DTRE View

The initial negative price response should cover the near-term risks, and Trump’s infrastructure spending plans and potential deregulation could end up boosting demand for metals in the medium to long term. Additionally, the last time Trump imposed tariffs on China, it took almost a year before implementation, and a similar timeframe or a watered-down version may limit the overall impact. Sluggish global demand and rising US stockpiles should limit price increases in oil in medium term.

Bonds

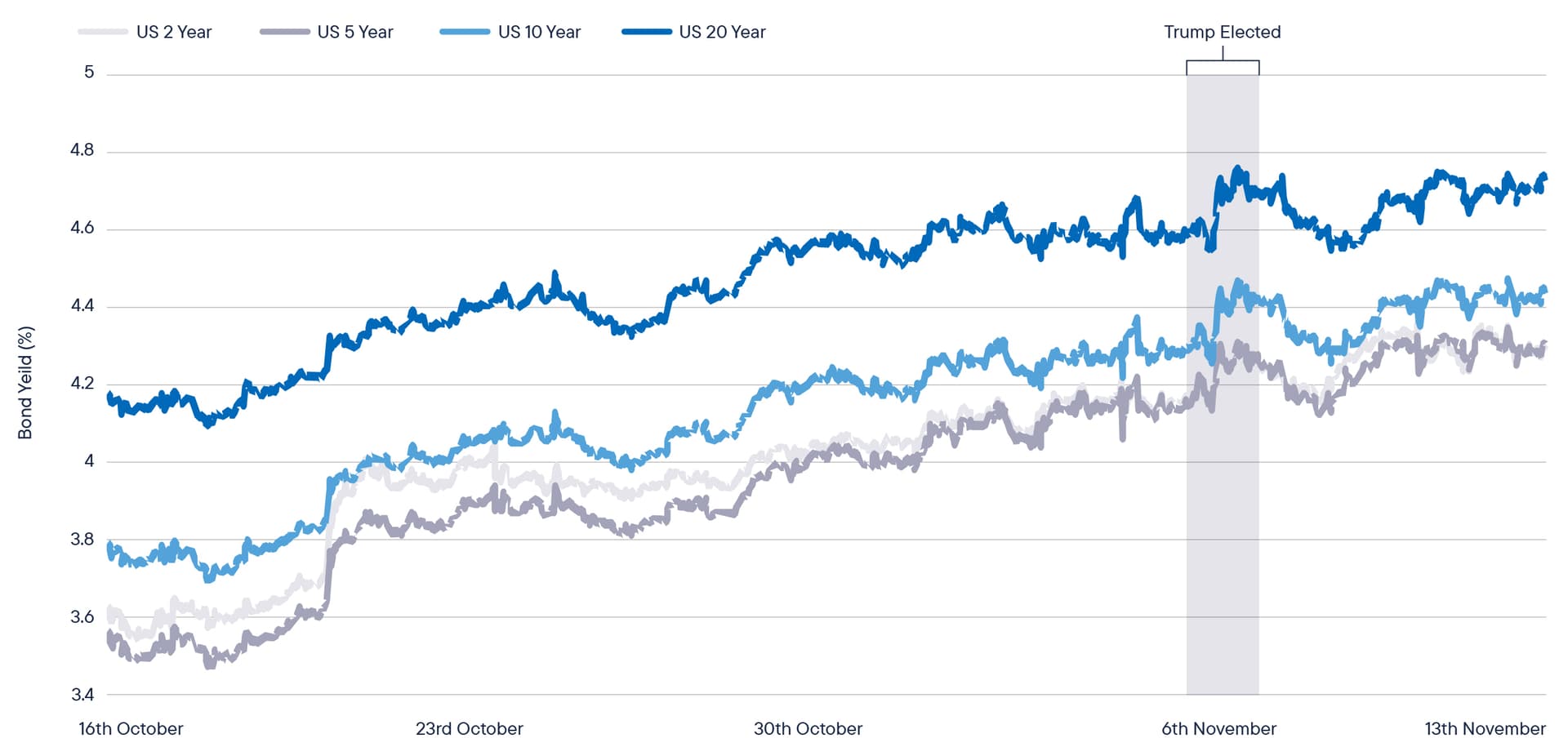

One of the most obvious reactions to Trump’s victory has been in US Treasuries. Prior to Trump’s victory the US yield curve was gradually normalising as the Fed proceeded with rate cuts. However, now yields have jumped amid the potential for economic reacceleration in 2025 due to Trump’s policies and therefore expectations of higher interest rates from the Fed to counter it (and this explains the rise in the yield on American government bonds in the last 12 days see chart below).

Trump’s victory will likely keep the Federal Reserve cautious about its rate-cutting trajectory.

DTRE View

Higher inflation and interest rates in America don’t automatically mean the same here but investors who know they can make 4.5% from US government bonds may decide that they won’t accept a substantially lower yield from the British equivalent, gilts. Gilt yields affect other borrowing costs such as mortgage and swap rates and so the re-election of Donald Trump may mean a higher cost of debt on this side of the Atlantic, all else being equal.

Commercial Real Estate

The relationship between Trump and the Fed will be critical to establishing the success or otherwise of commercial real estate under his leadership.

The US already has significant problems in its office markets, particularly downtown locations with significant levels of vacancy and continued interest rates and bond yields at >4.5% could mean it’s a relatively painful 2025 in the US commercial real estate sector.

If Trump’s tariffs come into full force then expect more reshoring and re-location of production both in the US but also in Europe, with a chance that the new US protectionist policies might actually end up supporting demand for European and UK manufacturing and logistics warehousing.

DTRE View

From a capital markets perspective, a resurgent US economy and strong dollar will make UK assets look relatively cheap and therefore could usher in a new wave of US Private Equity led investment, albeit the cost-of-capital will remain high, relative to the previous cycle.

Whilst Europe will look cheaper than the UK from a debt perspective, with German GDP expected to contract in 2024 and a general election in 2025, the French undertaking €60bn worth of tax rises and spending cuts and Italy’s economy forecasted to grow at half the rate of the UK in 2025, then the UK still looks a solid bet.

In terms of leasing, trade barriers and a further period of supply chain disruptions, which the experience of Brexit and Covid tells us, can ultimately lead to more demand for warehousing.

The UK’s life science sector could stand to benefit from the uncertainty created by Trump’s appointment of Robert F. Kennedy Jr., who’s pushed false claims about vaccine safety and has been nominated to be the new US secretary of health and human service. In that instance, the UK could be seen as a more business-friendly climate for life science companies, particularly those undertaking drug discovery.

Whilst the listed pharma businesses have all seen declines in their share price since the nomination of RFK Jr, that is largely to do with sales and the potential disruption to a market of over 330 million people. On the flip side, a more business friendly location could attract ‘Big Pharma’ with the associated boost to real estate, chiefly leasing of lab space.