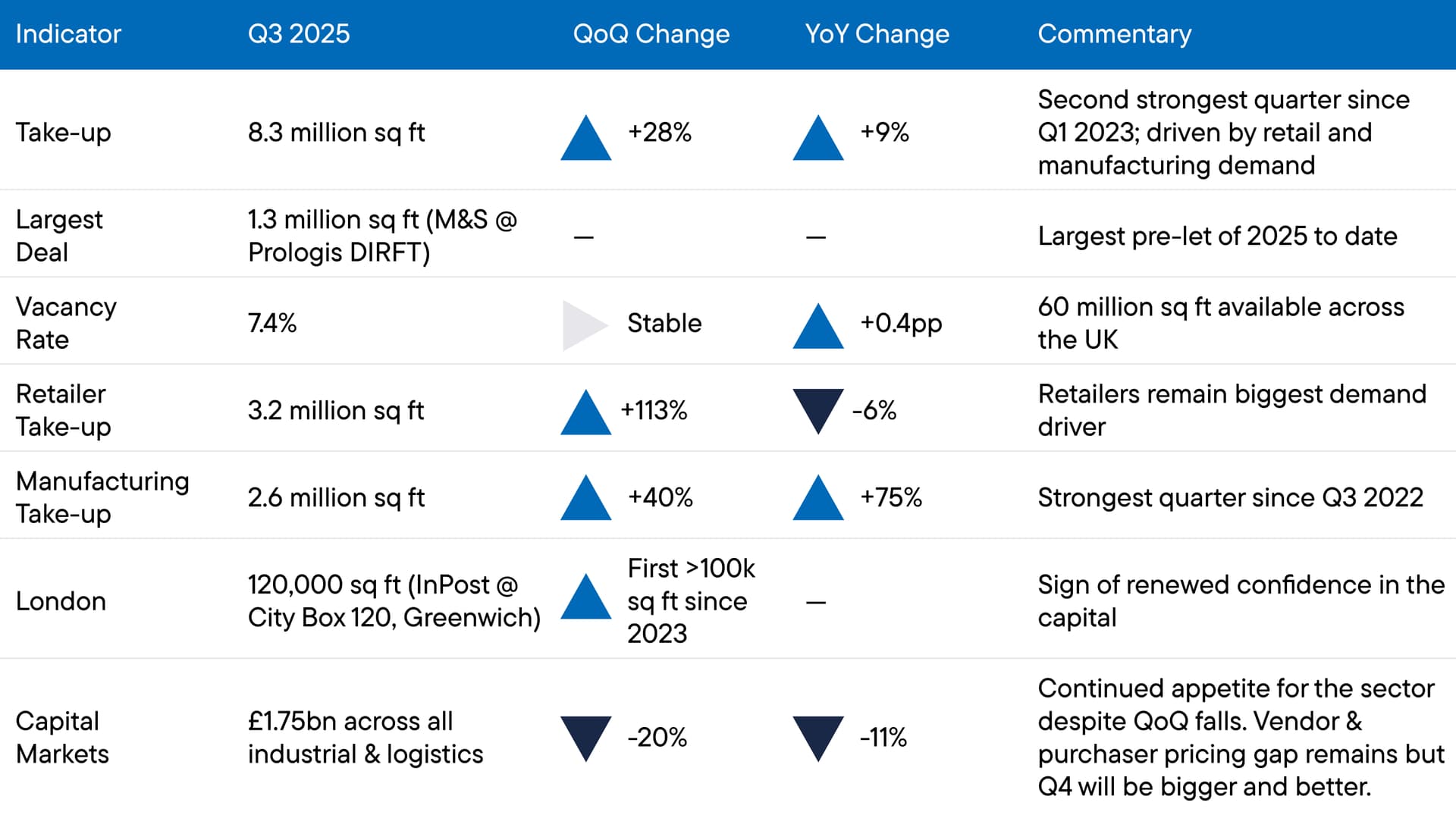

Key Market Indicators You Need To Know in Q3 2025

Source: DXTRE

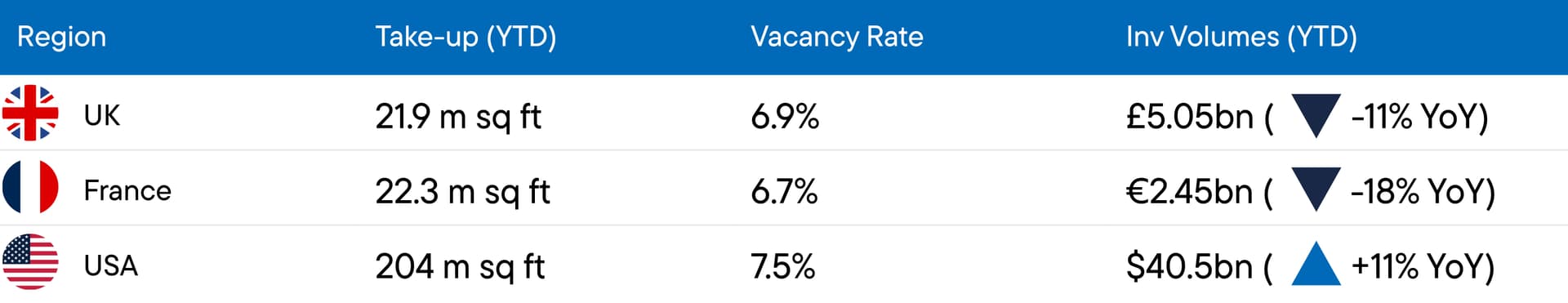

Broadening the Lens

From this quarter, we’re benchmarking the UK against key global peers. The new feature will highlight take-up, vacancy and investment trends worldwide, showing how the UK compares and where opportunities are emerging. As capital and occupier demand shifts and refocuses globally, this perspective will give sharper insight into the UK’s position in the international market.

Occupational Markets

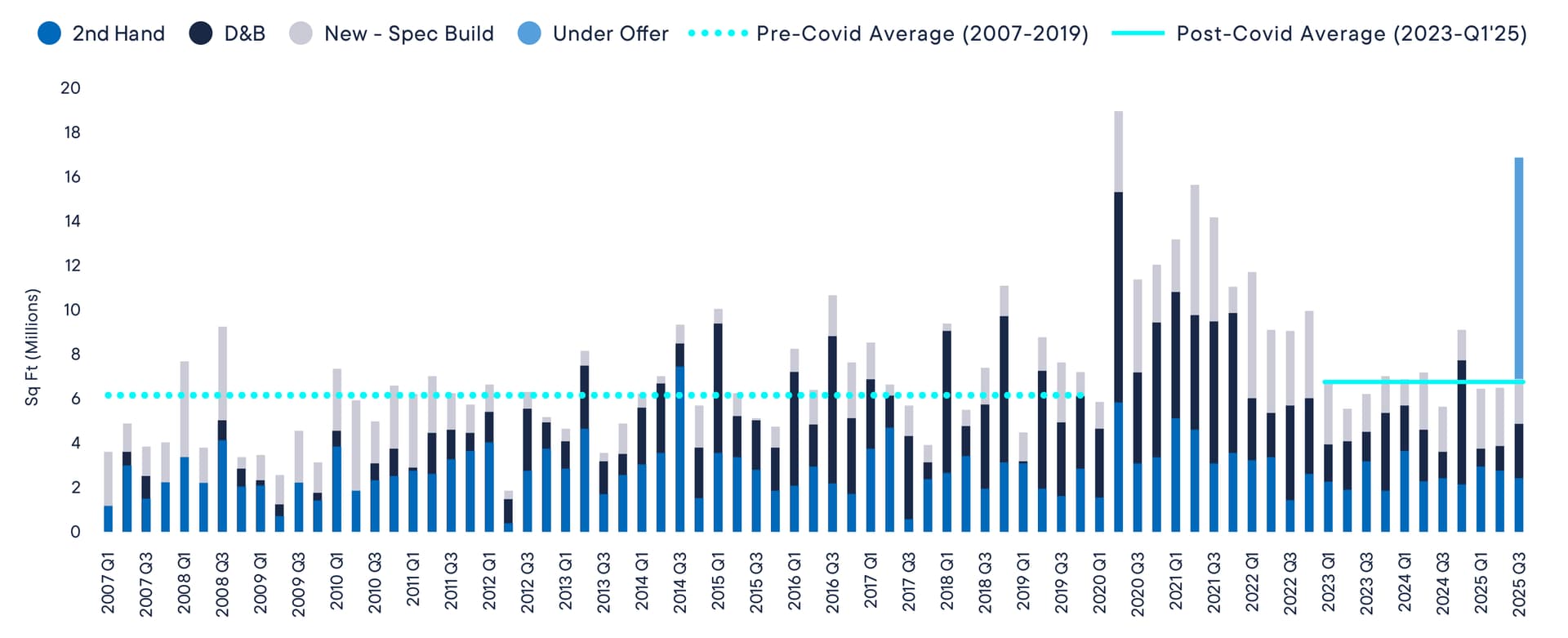

The Big Box market belied the perceived macroeconomic doom and gloom in Q3, with take-up rallying to its second-highest quarterly total in the past two years. There was 8.3 million sq ft transacted across 31 separate deals in the quarter, which is 11% ahead of the quarterly average seen since the end of 2022. This pushes year-to-date activity to nearly 22 million sq ft, sitting 9% above the same period last year and 7.5% ahead of the pre-Covid 10-year average (Q1–Q3).

Retailers remained the dominant occupier group, continuing to optimise supply chains and promote network efficiencies. However, manufacturers also made a strong return, taking their largest share of space since 2022, a signal that domestic consumption and production as well as supply chain consolidation remain key themes.

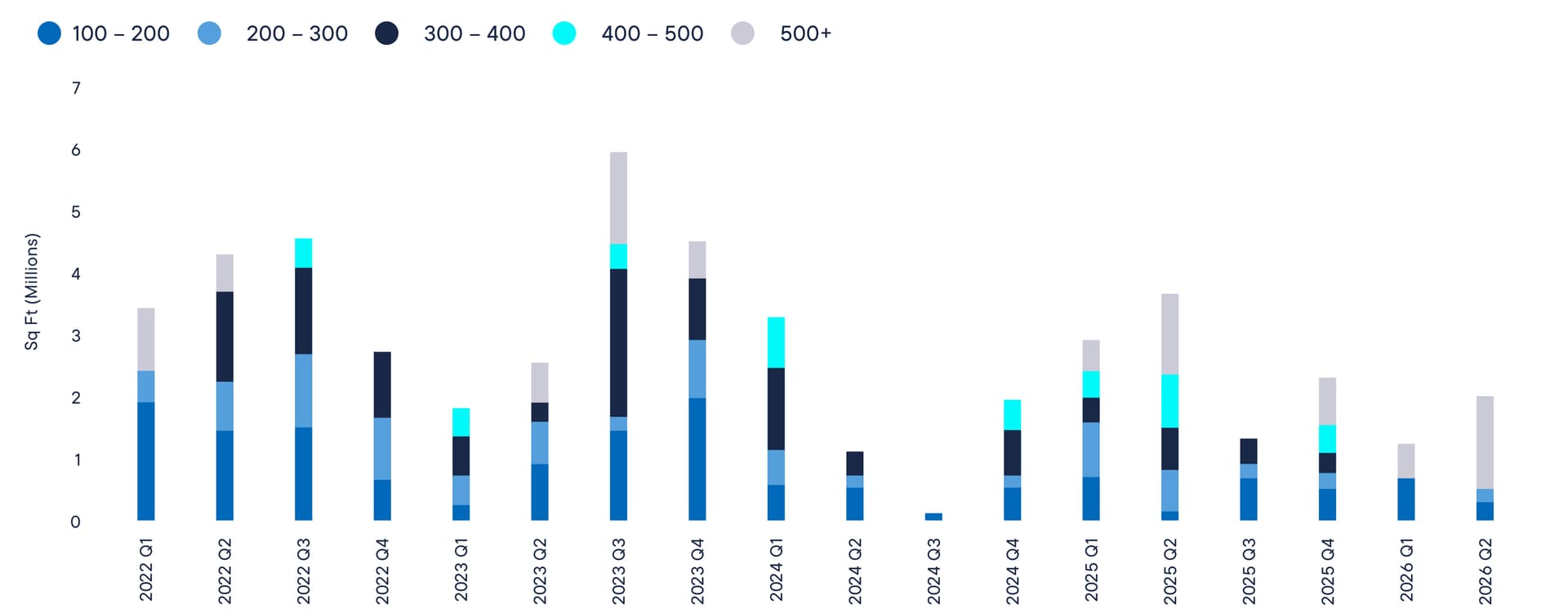

Fig 1. Take-up by Grade and by Quarter

Source: DXTRE

Indurent’s letting of its Omega 420 scheme in Warrington to Regency Glass was the standout manufacturing deal of the quarter, but on the whole there were 11 separate deals to manufacturers of various types, and that’s the second-best quarter in the last 5 years. The 1.3m sq ft pre-let by M&S at Prologis’ DIRFT was the biggest deal of the quarter, as well as the year, to date.

Geographically, the Midlands reaffirmed its status as the UK’s logistics heartland, accounting for nearly half of all take-up by volume (47%) and 13 of the 31 deals recorded. The South East and London saw renewed momentum with 6 deals, it’s best quarter since Q2’22 and capped by the InPost deal in London, the first Big Box transaction over 100,000 sq ft in the capital since late 2023.

Interestingly Q3 also saw the return of the ‘XXL shed’. There were 8 separate lettings of 300,000 sq ft plus in Q3, that’s more than in any other quarter in the last 3 years and as a result there’s now just 15 new/spec built units available between 300-400,000 sq ft in the UK, that’s a fall of 35% this year and there are currently zero units of this size under construction now Logicor’s Bolt 330 in Manchester has reached completion.

In terms of the overall supply and vacancy picture, the DTRE Big Box Vacancy Rate has remained flat over the last three months at 7.4% and there is currently 60.3 million sq ft of vacant units across the UK, with the Midlands accounting for 41% of that total. The majority of the currently available supply (64%) is second-hand with 21.9 m sq ft of vacant ‘new spec built’ units on the market, which is a fall of close to 3% over the quarter.

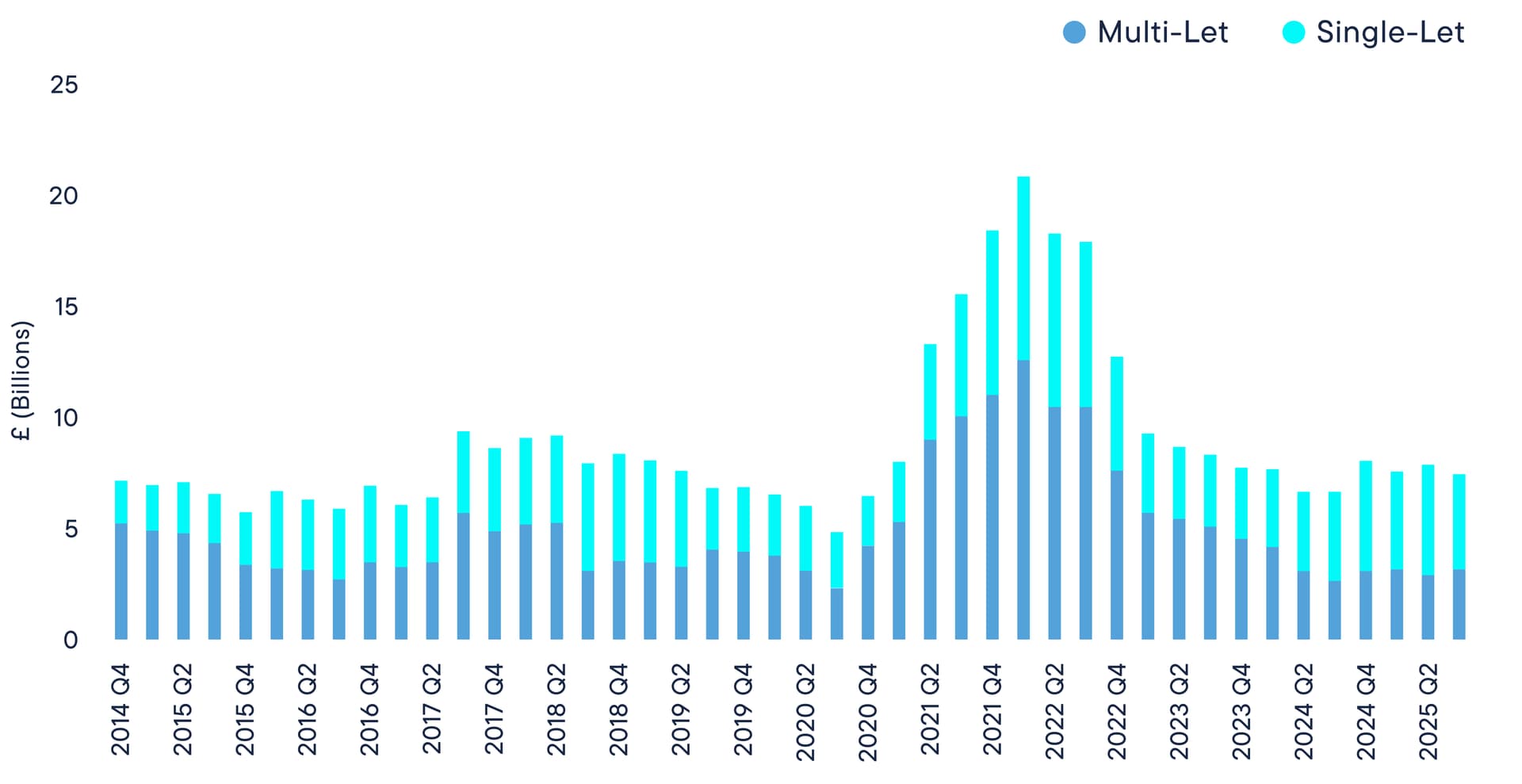

Fig 2. Speculative Development Outlook is Subdued

Source: DXTRE

There’s now just shy of 6m sq ft of new/spec built product due to p/c over the next 12 months, with the four quarter rolling total averaging c.10.9 million sq ft over the last 10 years, this demonstrates a considerable slowdown in the Big Box development market. Given the relatively meagre amount of new supply coming on-stream then we expect to see a move down in the vacancy rate by the end of this year and into 2026.

Whilst the macro-economic backdrop, and later than anticipated budget could eat into business sentiment in Q4, there is an expectation of continued occupier activity in the Big Box market, particularly given the c.10million sq ft of deals currently under offer. Combine this with the number of large requirements circulating from retailers and defence manufacturers in-particular and a limited development pipeline, the market is well-positioned for a strong finish to the year.

Capital Markets

Again despite the macro noise, the UK logistics investment market held firm in Q3, with £1.75 billion transacted, broadly in line with the three-year quarterly average. In a continuation of what we’ve seen over the last six to nine months, activity was underpinned by deals at either end of the pricing barbell, with continued appetite for big ticket ‘Big Box’ portfolios and whole logistics parks of c.£80m plus, as well as smaller ‘value-add’ deals that provide opportunity to bolt-on assets to existing aggregation strategies and drive returns through active asset management.

The standout transaction of Q3 was Blackstone’s £489 million take-private of Warehouse REIT, reaffirming their confidence in the long-term fundamentals of the sector. On the single-asset front, Pontegadea’s purchase of an Amazon facility just outside of Liverpool for £80m/5.00% marked the largest individual deal of the quarter.

Fig 3. Rolling 4 Quarter Investment Volumes

Source: DXTRE

Yields held steady through the quarter from a valuation perspective (4.82% distribution warehouse NIY from MSCI in July to 4.84% NIY in Aug), however, there remains a disconnect between vendors and purchasers when it comes to actual deals, with vendors unable or unwilling to sell at below valuation and purchasers unwilling to be seen to be paying ahead of the perceived ‘market’ rate. With seemingly plenty of liquidity in the debt markets for logistics assets this has resulted in some portfolios being re-financed, rather than sold in the last quarter.

Looking ahead, the remainder of 2025 is likely to be shaped by macroeconomic headlines — particularly around the UK’s Budget in late November, any resulting gilt market sensitivity and the resultant knock-on effect to further rate cuts.

Yet positively, there remains significant capital waiting to access the sector. As has been the case for the last 18 months or so, the challenge lies not in demand or weight of money targeting the sector, but in bridging the gap between vendor and purchaser aspirations. However, with the anticipation of more ‘core’ capital entering the market from 2026, particularly given the re–organisation of the Local Government Pension Schemes (LGPS), we think that gap could be bridged before too long.

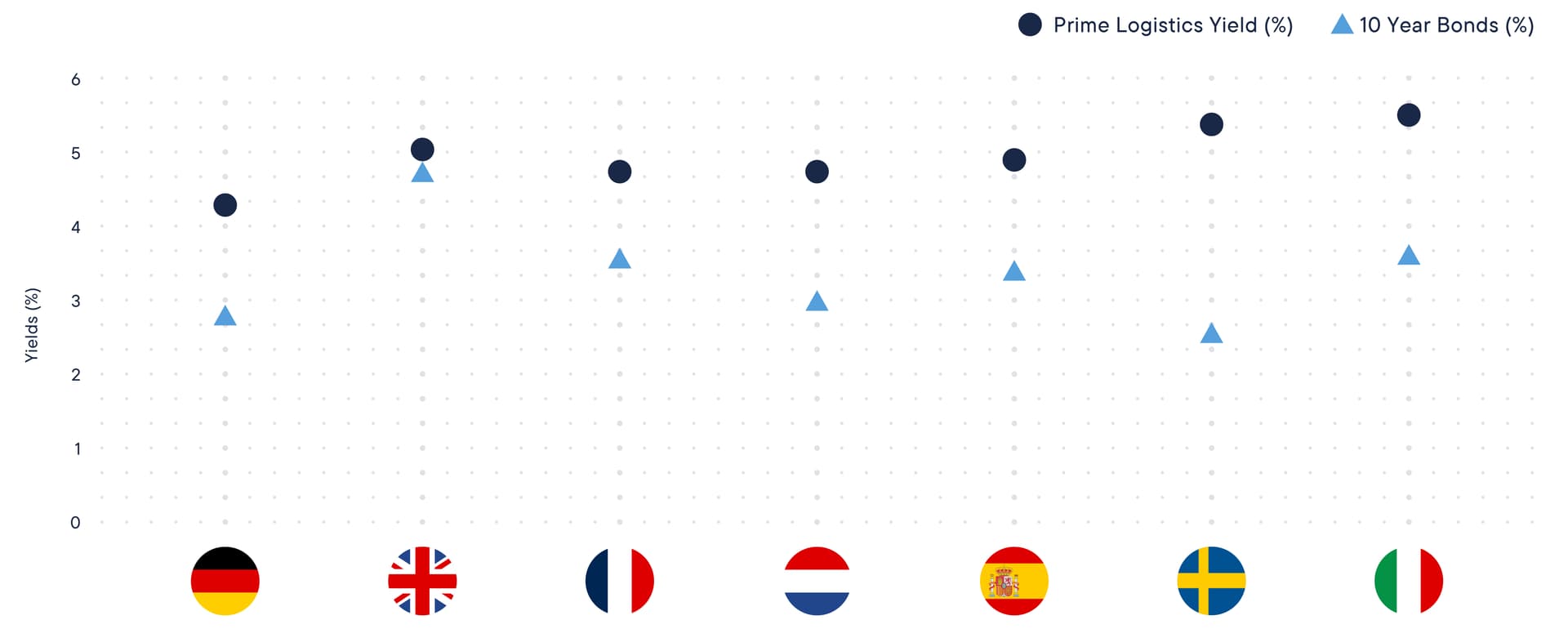

Fig 4. UK Prime Logistics & Bond Yields vs European Peers

Source: DXTRE