Q3 2025 Golden Triangle Foreword

While announcements from Merck, AstraZeneca, Lilly, Sanofi and GSK have temporarily dampened sentiment around the UK’s science and technology market, they don’t reflect a structural retreat from the UK. These firms remain committed to their existing R&D bases here, and in many cases are simply re-sequencing capital expenditure amid NHS pricing uncertainty and impending patent cliffs for block buster drugs.

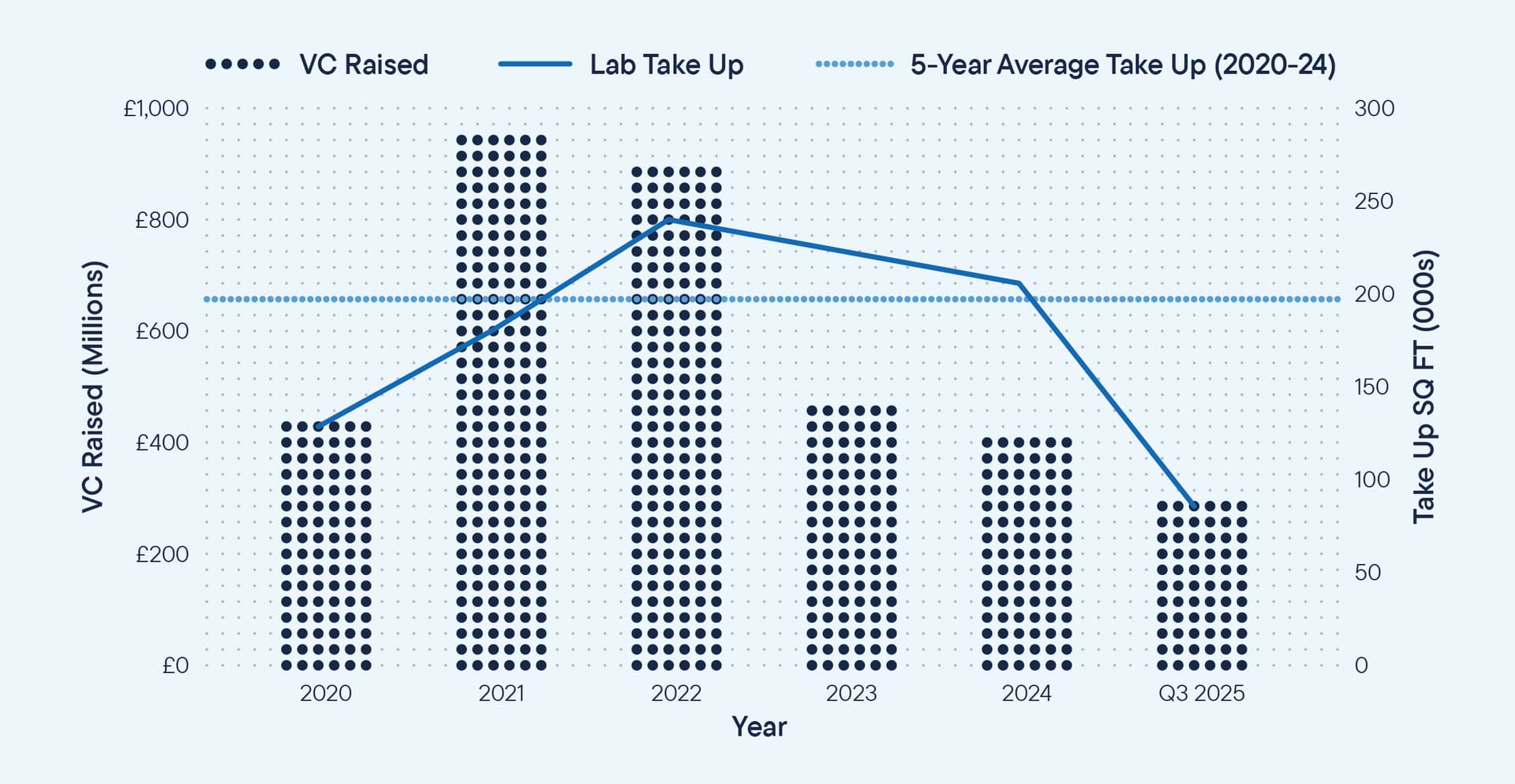

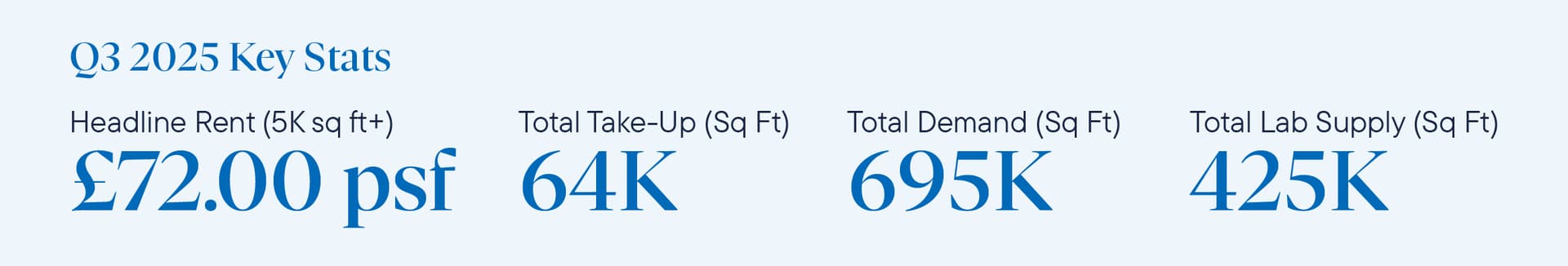

We’re undoubtedly in a period of recalibration rather than decline. Lab take up across the Golden Triangle has increased by 21% year-on-year, driven by a 493% increase in London deals and largely reflecting market caution in Oxford and Cambridge rather than a fall in named active occupier demand, which has increased quarter-on-quarter by 16% to 2 million sq ft.

Whilst a spate of new buildings reaching practical completion this year has skewed the supply side, increasing availability by 83% year-on-year to 1.3 million sq ft, this is still behind the total demand across the Golden Triangle.

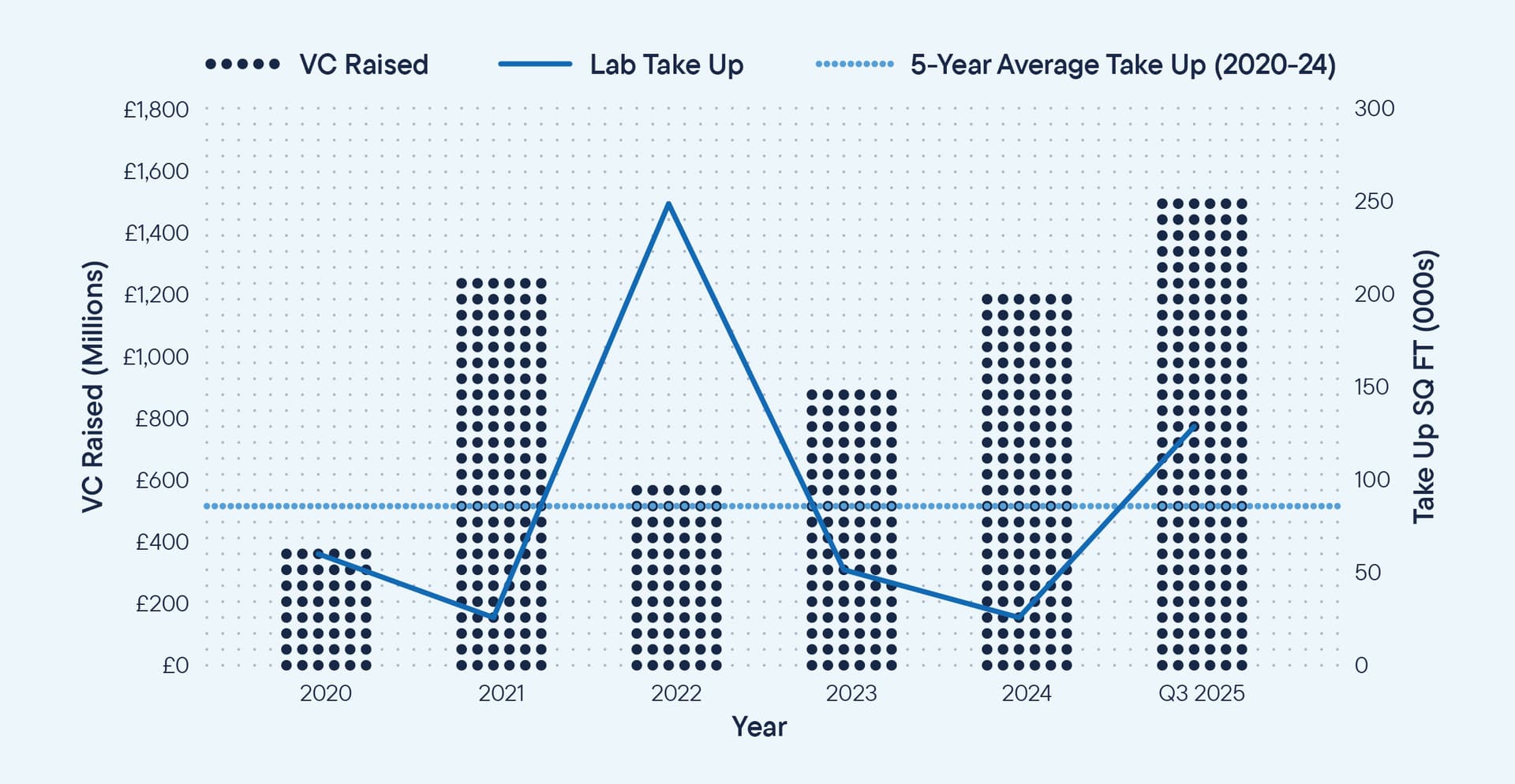

The funding environment paints a bright picture with over £2.3 billion raised throughout the Golden Triangle in the year to date. This is 33% ahead of the previous year’s raises and demonstrates there is still capital appetite for early and later stage biotech and life science companies, albeit the raises are taking longer to close.

The underlying fundamentals of the sector in the UK of world-class universities, access to talent, a robust funding universe and the continuing convergence between tech and science in London, Oxford and Cambridge remain powerful demand drivers.

From a property market perspective, we’re seeing a flight to quality. Well-located, purpose-built lab spaces continue to attract stronger occupier attention, while secondary assets in terms of either location or specification face longer Leasing voids. There are many positives to focus on, if we can look through the noise.

At the time of printing the Ellison Institute announced its £890m deal with The Oxford Science Park and JV partner GIC to acquire approximately 46 acres of the park, including the 450,000 sq ft Daubeny Project that is under construction. This not only marks a huge vote of confidence in the UK’s science and technology sector with the largest capital markets deal for approximately 5 years, but also underscores the importance of looking through the noise. Only time will tell, but I am hopeful that we have now passed the nadir and that the tailwinds highlighted in this report will begin to generate more positive news stories.

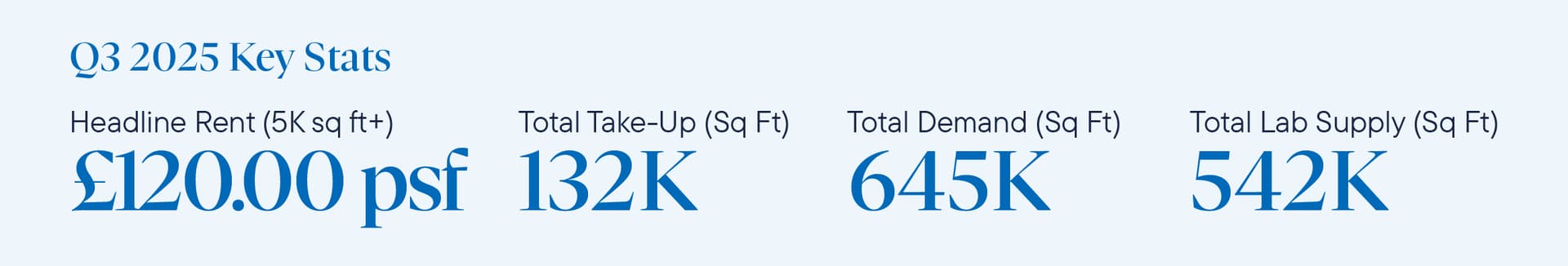

Lab and midtech take-up in London reached an impressive 132,000 sq ft by the close of Q3 2025, 493% up on the 22,300 sq ft of take up in the same period last year. Key deals included OriBiotech and Plasmidsaurus securing space at Kadans’ Mayde, 5–10 Brandon Road, alongside additional take-up at LBIC, Apex by BIND Research, and Twig Bio. A further 15,000 sq ft was under offer at the end of September, with more transactions anticipated before the end of the year at Mayde and Imperial’s Victoria Industrial Estate.

London’s Knowledge Quarter continued to lead activity, accounting for 59% of Q3 take-up and 79% of year-to-date transactions. Demand followed a similar trend with 67% of active requirements specifying a preference for space within the Knowledge Quarter. Across London, active demand totals 197,200 sq ft, with a further 447,500 sq ft either on hold or expected to activate within the next 6 to 12 months.

The quarter also saw further floors reach practical completion at Pioneer’s Victoria House, as well as 1 Triton Square delivering 313,000 sq ft of lab enabled office space, with 43,500 sq ft of fitted labs, bringing total available built lab space in London to 587,200 sq ft. Notable vacancies remain at purpose-built lab schemes including ARC’s The Refinery, Kadans’ Mayde, and Reef and Blackrock’s Apex, Tribeca, where Eli Lilly recently withdrew from its committed space.

London’s science sector continues to outperform its Golden Triangle peers in capital raising, with over £1.5 billion secured to date in 2025, the strongest year on record. The capital accounts for 65% of all Golden Triangle fundraising and consists of 122 separate raises, double the combined total of Oxford and Cambridge. Of capital raised, 48% was for early-stage rounds (seed, Series A-B), with later stage VC funding (Series C-D) making up the next largest percentage at 22%.

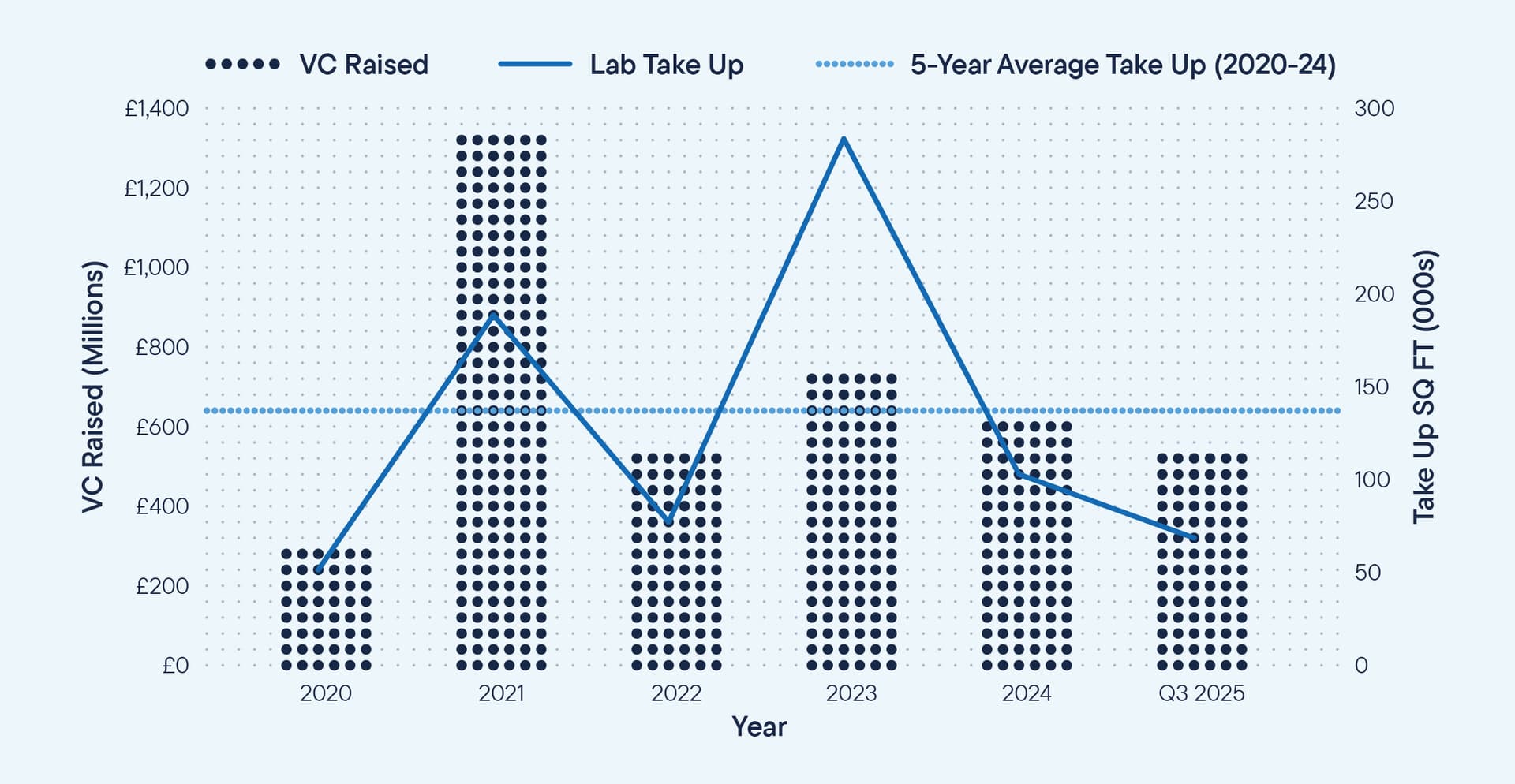

Lab and midtech take-up in Cambridge reached 63,600 sq ft by the end of September, marking a 33% decline year-on-year. Despite this slowdown, an additional 98,200 sq ft was under offer at the end of Q3, including 36,600 sq ft at Peterhouse College’s Q-Arc, Saxon Way. Should these transactions complete before year-end, total take-up will exceed Cambridge’s five-year annual average of 139,000 sq ft by approximately 16%.

Active demand remains robust, standing at 344,500 sq ft, with a further 350,000 sq ft of demand currently on hold or anticipated to come live within the next 6 to 12 months.

On the supply side, new lab completions include Longfellow’s CamLife 3 and Brydell’s First Step by Journey, together adding 54,800 sq ft to the market. These join Abstract’s best-in-class South Cambridge Science Centre with approximately 120,000 sq ft available following its deal with Frontier IP, Mission Street’s Phase 2 of The Press with 64,400 sq ft available, and BioMed’s 1 Granta Park, which retains around 50,000 sq ft of availability despite 28,000 sq ft of office space being currently under offer to Gilead.

Venture capital activity continues to strengthen with life science and biotech firms across Cambridge raising £529 million to the end of Q3, a 6% increase year-on-year. Notably, 85% of this funding was secured through later-stage venture capital (Series C and beyond), highlighting the more mature status of the Cambridge market.

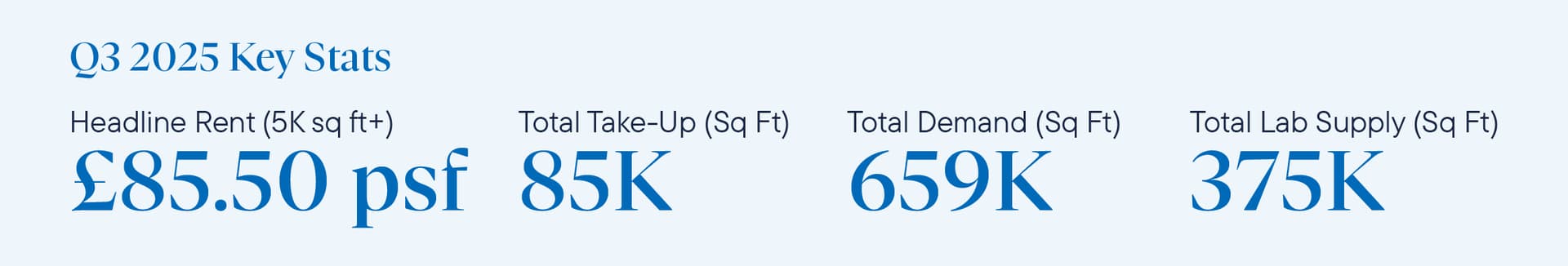

By the end of Q3 2025, Oxford recorded 85,100 sq ft of lab and midtech take-up. Notable transactions included Salience Labs occupying 6,700 sq ft of dry lab space at 100 Park Drive and Inify taking 11,600 sq ft of midtech space at Nebula, both at MEPC’s Milton Park. While 26,600 sq ft remained under offer at quarter-end, take-up was set to fall short of the five-year annual average (200,300 sq ft), until the landmark announcement in October that the Ellison Institute will occupy the 450,000 sq ft Daubeny Project at The Oxford Science Park. This deal will propel annual take-up to 167% above the five-year average, marking a record year for Oxford and helping to reaffirm investor confidence in the UK’s science and technology ecosystem.

Active demand across Oxford held steady at 276,000 sq ft, with a further 383,200 sq ft in the pipeline. Supply remains the tightest within the Golden Triangle here, with 374,600 sq ft of completed lab space available. Despite this, it is up from 282,900 sq ft last quarter, due to Oxford North Phase 1 reaching practical completion, delivering c.106,000 sq ft of lab space across 1 & 2 Fallaize Street, alongside office and amenity space at The Red Hall. Looking ahead, the key completion of Breakthrough Properties’ Trinity House (214,000 sq ft) is expected to further bolster lab stock in Q4.

Funding activity in Oxford remains subdued relative to London and Cambridge, with £290 million raised by the end of Q3, moving marginally ahead of the £273 million achieved during the same period last year. Of this, 63% was private equity funding, 33% was allocated to later-stage VC and just 4% was seed funding.