Q4 2025 Golden Triangle Foreword

Key Takeaways

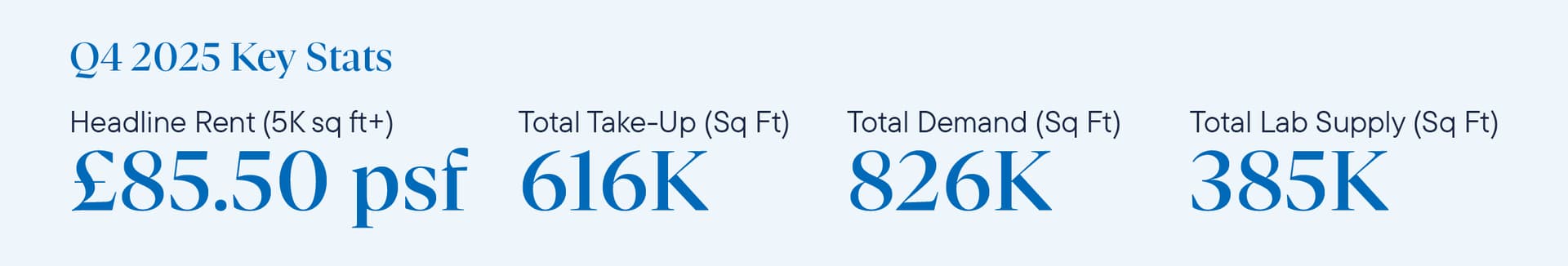

- Take up reached a record 851,800 sq ft, driven by the Ellison Institute at The Oxford Science Park.

- Occupier sentiment improved across the sector by year end, with viewing activity and deal momentum picking up.

- AI dominated demand and investment.

- Fundraising is starting to rebound, but remains challenging and key in delaying real estate decisions.

- Availability has increased across the Golden Triangle, driven by a large influx of completions.

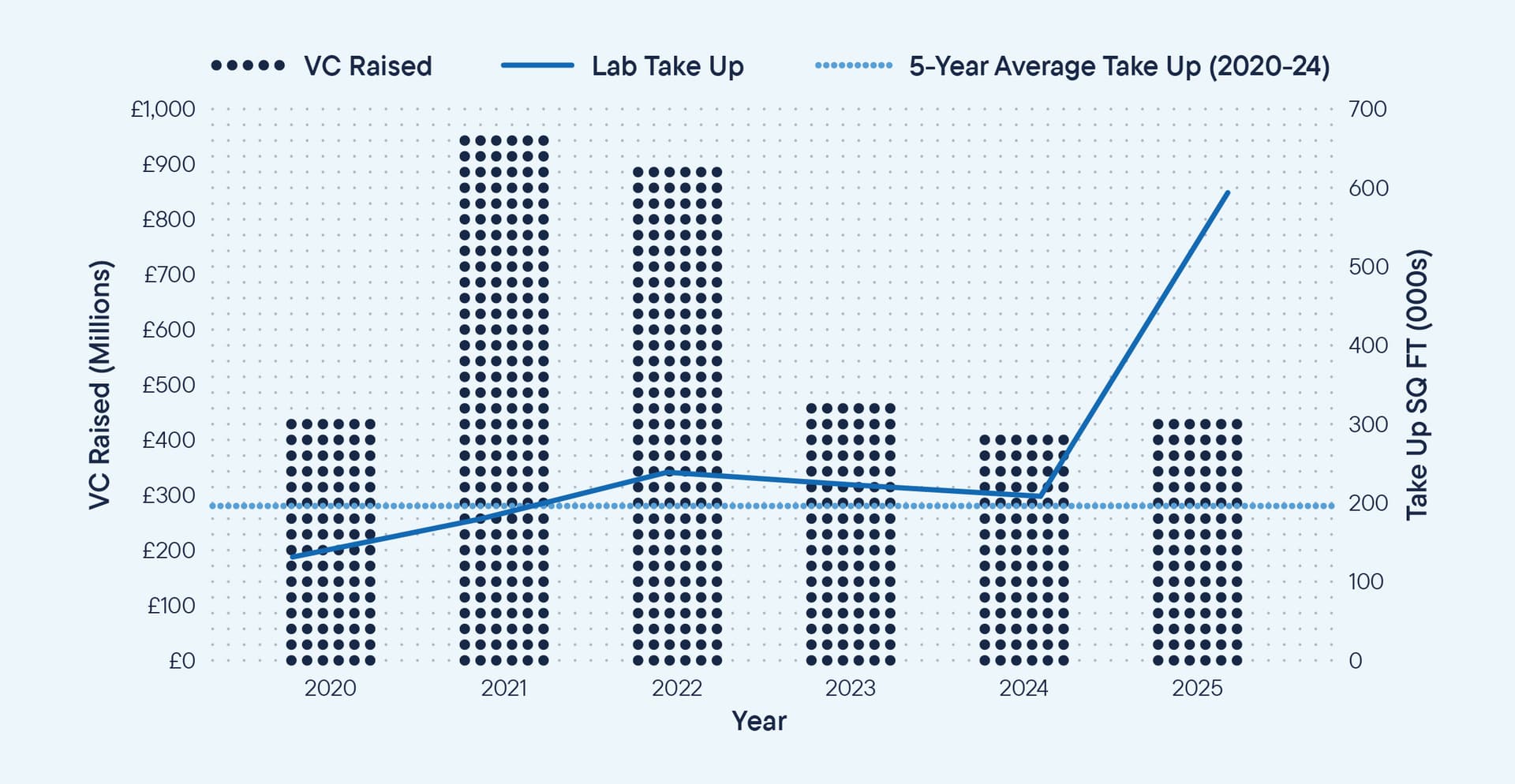

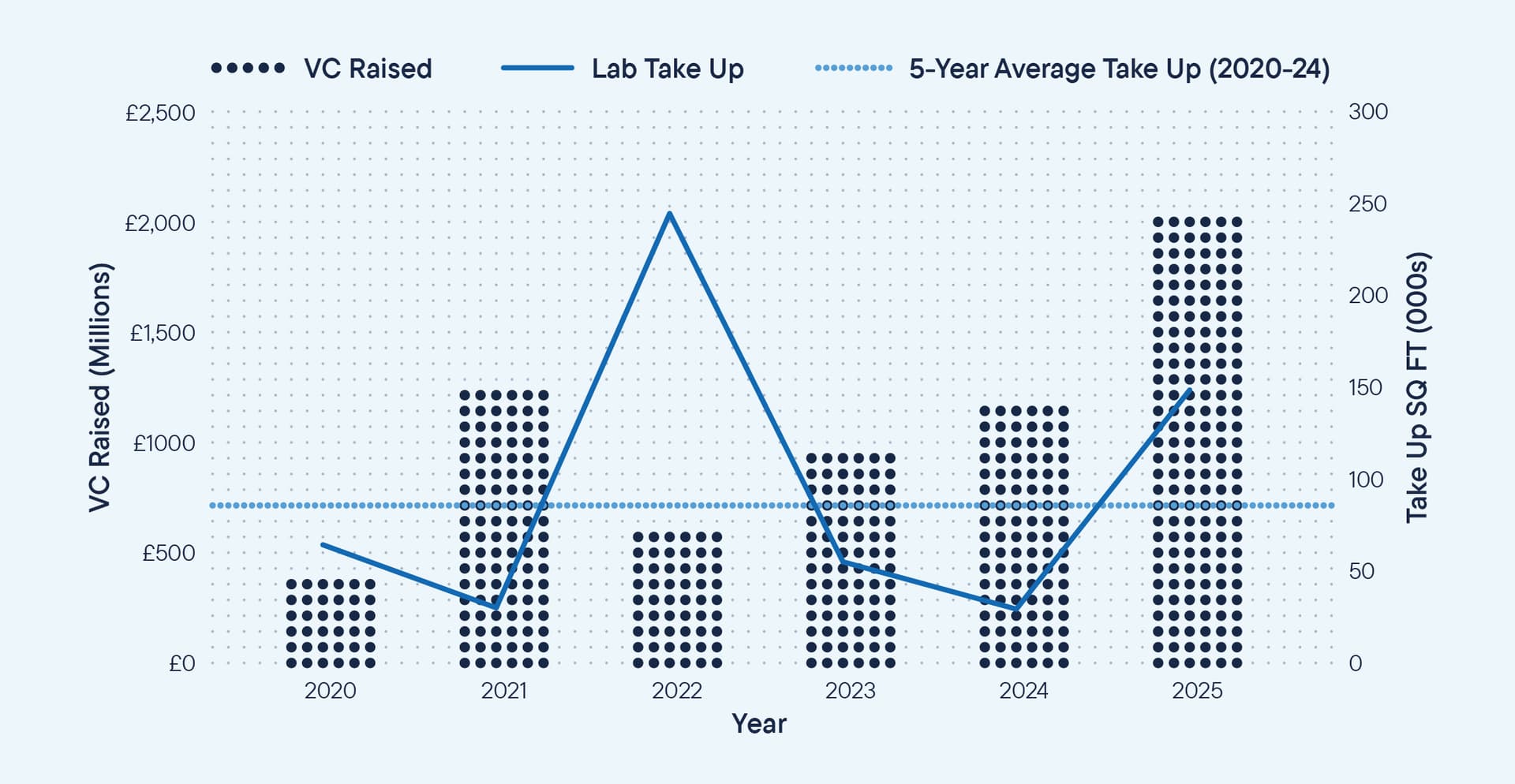

Across the Golden Triangle, lab and midtech take-up reached 851,800 sq ft in 2025, representing a 152% year-on-year increase, more than double the five-year average of 411,900 sq ft. It’s important to note that this figure does include the Ellison Institute taking the entirety of the Daubeny Project (450,000 sq ft) in its acquisition of the west of The Oxford Science Park. Towards the close of the year, we saw a clear shift in viewing activity, with conversations that had previously been slow starting to gain momentum. Occupier sentiment became notably more positive, potentially driven by improving conditions in the funding environment, alongside macro-economic uncertainty becoming, in many ways, predictably unpredictable. This momentum has continued into 2026, leaving us cautiously optimistic for a more positive year ahead.

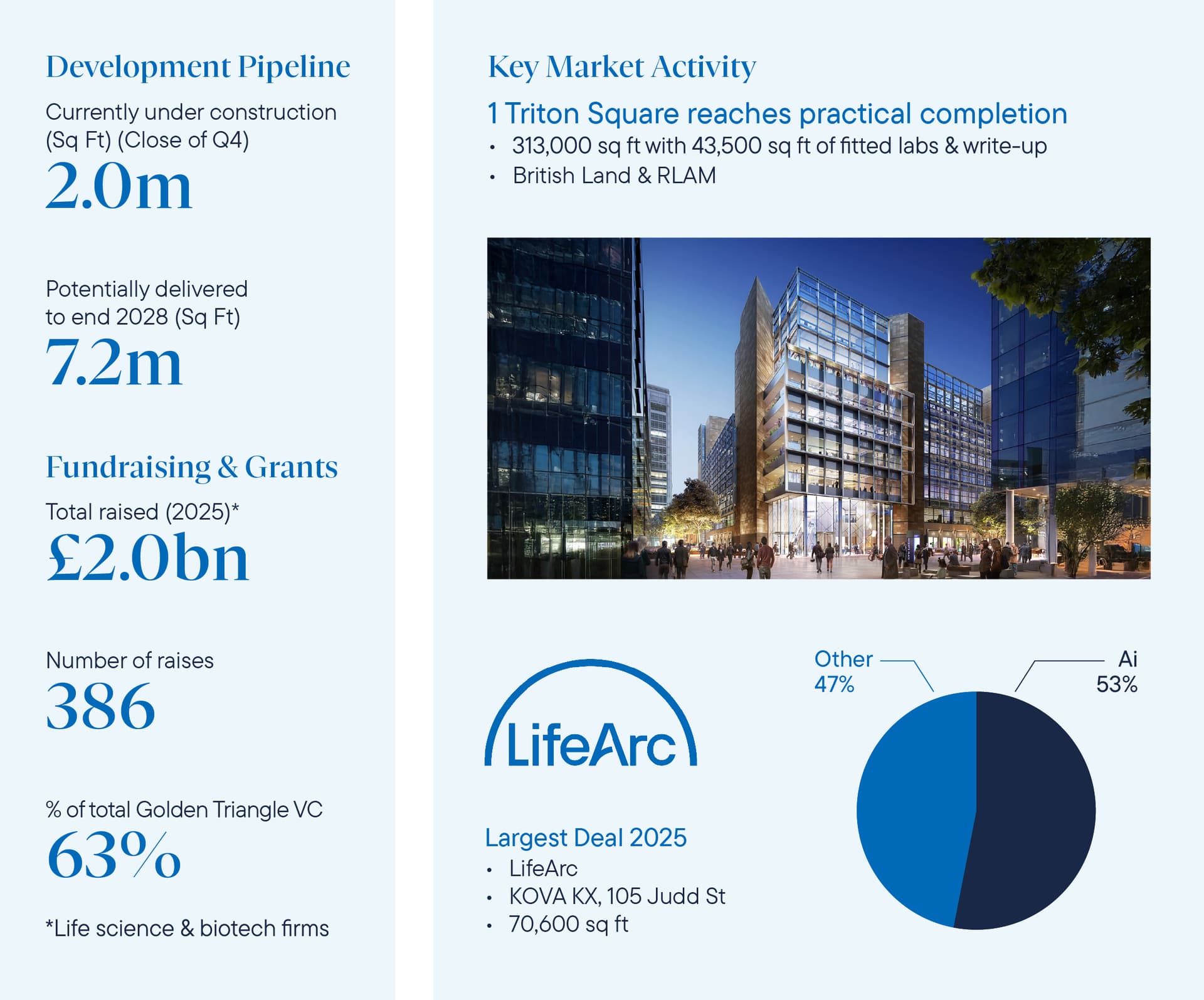

2025 was also the year that AI firmly moved to the forefront of discussions, particularly in the second half of the year. Demand and fundraising from this sector increased significantly, whether through life science companies embedding AI more deeply into their research processes, or AI-led businesses directly seeking lab or office accommodation. Of UK fundraising in 2025, 35% was dedicated towards AI. In London in particular, 53% of science and biotech investment went to AI-led businesses. With this, power availability has become more critical than ever, often the key factor of any requirement.

Fundraising across the UK was encouraging in 2025, reaching £4.8 billion, up 48% year-on-year, with 42% of this occurring in London. Whilst it very much feels as though the funding taps are beginning to open; fundraising is still difficult. Throughout 2025, we saw an increase in requirements coming to market, only for real estate searches to be pushed out and delayed as funding failed to materialise in the expected timeframe.

Hereby, whilst there is a weight of capital raised that needs to be deployed, there remains a degree of friction in the market, both in recruitment and real estate expansion.

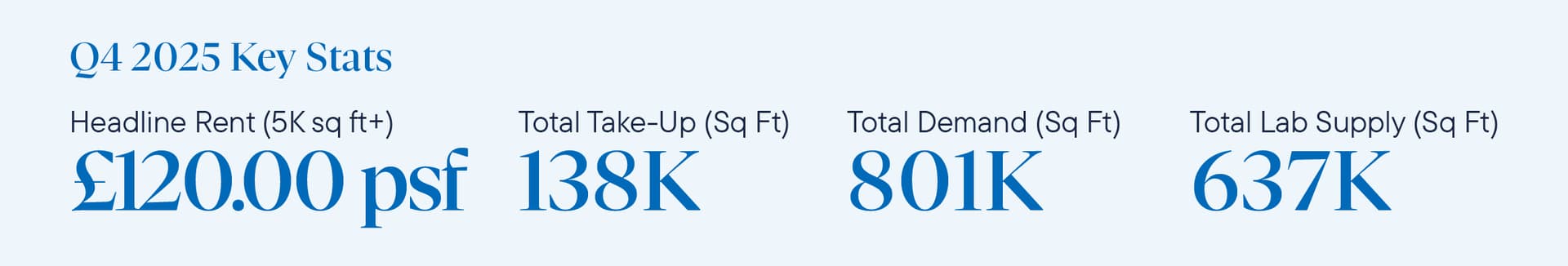

London take-up reached 138,000 sq ft in 2025, more than 3.5 times the total sq ft transacted the year prior and 63% above the five-year average take-up of 84,600 sq ft. Whilst these figures are no doubt positive, it is important to recognise that 51% of this take-up was driven by LifeArc signing for the entirety of Ashby Capital and Native Land’s KOVA KX at 105 Judd Street (70,600 sq ft).

Looking specifically at the final quarter of the year, 5,900 sq ft of lab space was let across the capital. This included Valink Therapeutics’ expansion at Imperial’s Translation and Innovation Hub (I-HUB) in White City, where the company now occupies over 3,900 sq ft.

Headline rents in London have remained stable at £125.00 per sq ft, last achieved at Kadans’ Mayde at Tileyard Quarter in 2024. With a significant volume of stock completing in 2025 across schemes such as Apex, Tribeca, The Refinery at Arc’s West London Campus, Pioneer’s Victoria House and British Land’s One Triton Square, occupiers have genuine choice for the first time in the London lab market. This has driven a tenant-led market and, in turn, a lag in rental growth.

At the close of Q4 2025, 637,000 sq ft of lab space was available, pushing the vacancy rate to 31%, up from 15% at the close of 2024. A further 558,100 sq ft is scheduled for delivery in 2026, of which 87% (484,100 sq ft) remains available at the close of 2025.

Despite the current level of availability in the market, there is key interest across the likes of Kadans’ Mayde, British Land’s One Triton Square, and the remaining space at Apex Tribeca, leading us to anticipate an uptick in net absorption.

By year-end, we were tracking 801,400 sq ft of named demand, with 280,000 sq ft currently active. Whilst this remains inadequate relative to supply, active demand is up 13% year-on-year, with total demand almost doubling. This highlights the increasing interest and growth in the London lab market. Of active demand, 52% by count was for space under 5,000 sq ft, 14% for 5,000 to 10,000 sq ft, 24% for 10,000 to 30,000 sq ft, and 10% for space over 30,000 sq ft. This is reflective of the nascency of the London market, where the majority of companies remain early-stage spinouts.

From a venture capital perspective, science and biotech firms headquartered in London raised £2 billion throughout 2025, representing a record level of investment driven by Isomorphic Labs’ $600 million raised at the beginning of the year. Of this, 33% was early-stage venture capital, with a further 28% allocated to later-stage VC.

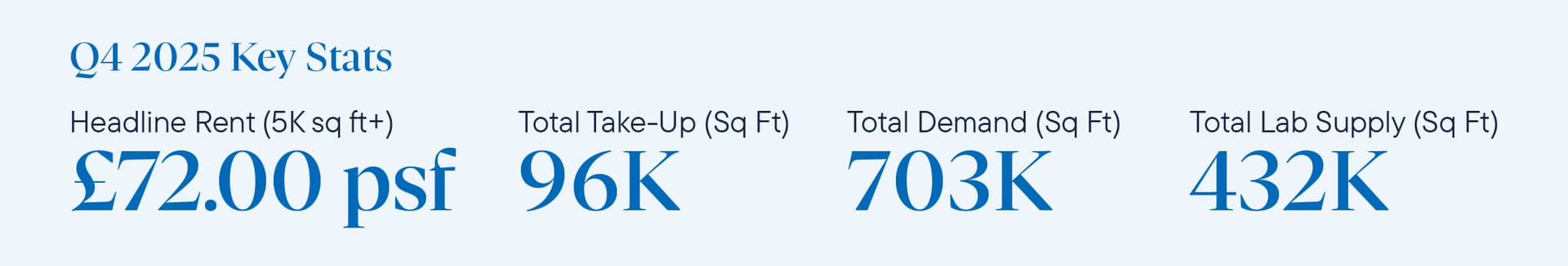

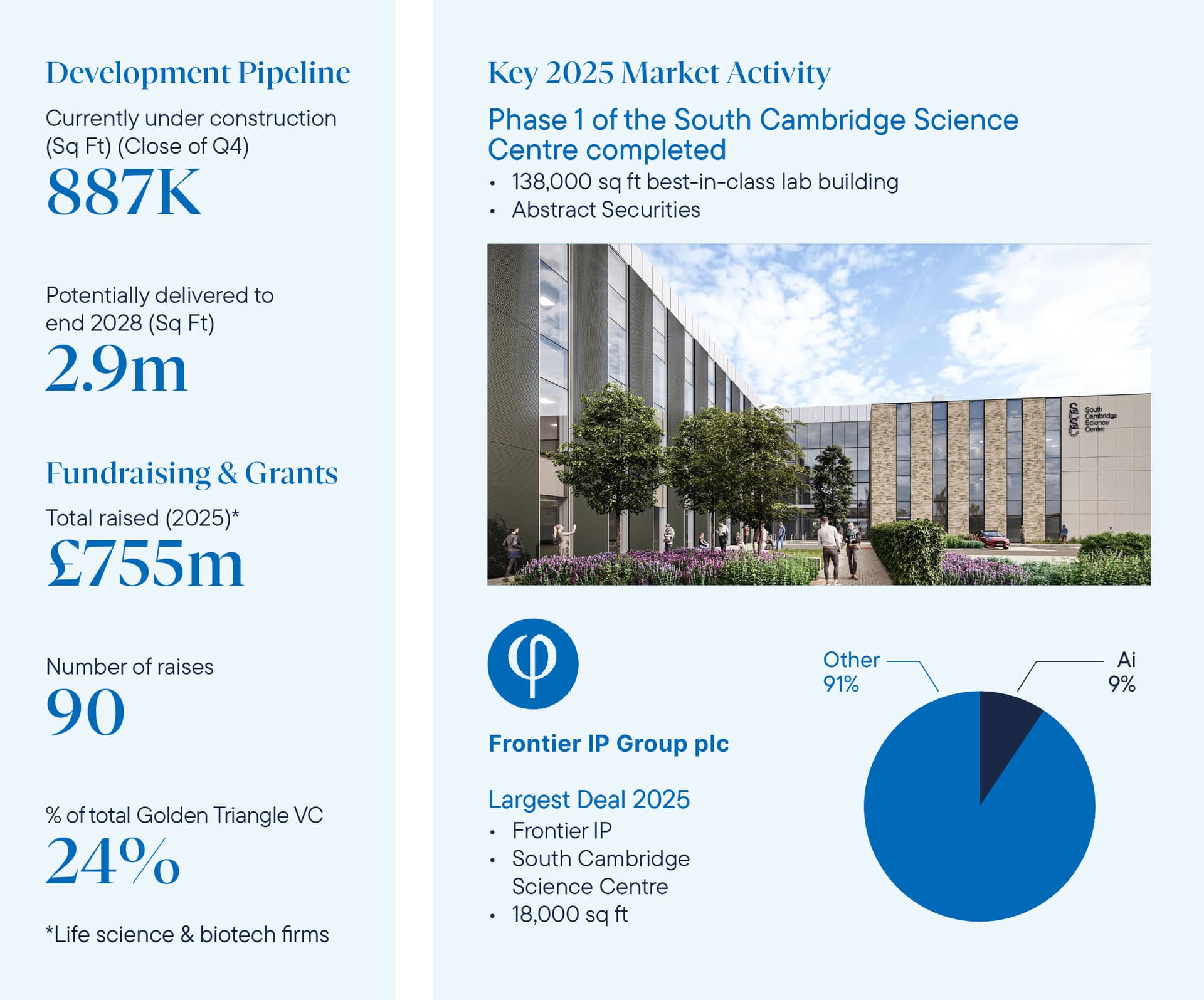

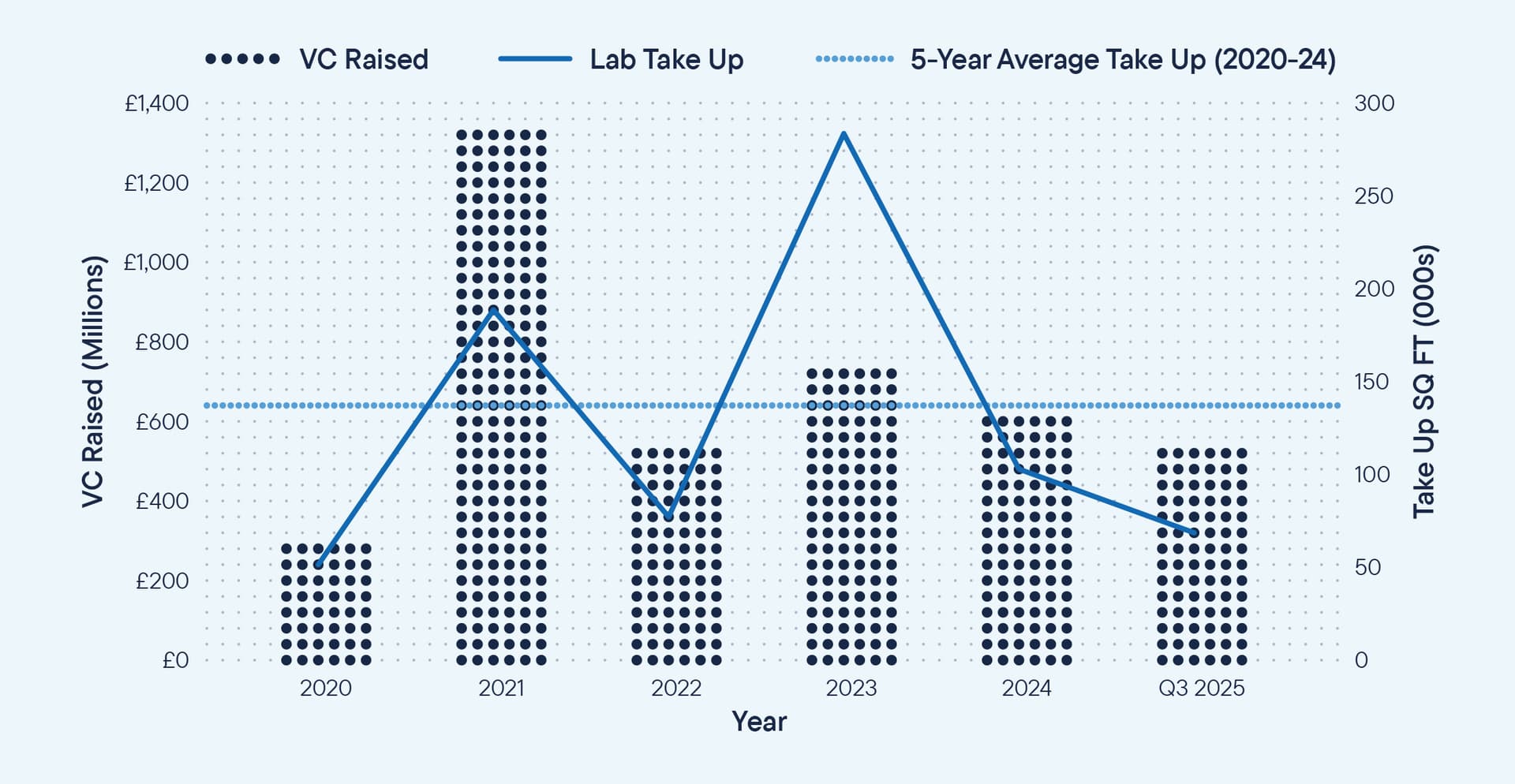

Take-up in Cambridge during 2025 lagged its Golden Triangle counterparts, with 96,100 sq ft of lab and midtech space transacted. This sat below the five-year average of 139,000 sq ft and was 1.2% down on 2024. Despite this, a further 60,800 sq ft was under offer at year end, with an additional 121,500 sq ft going under offer in early 2026.

In Q4, Nxera Pharma took 13,100 sq ft at the Cori Building on BioMed Realty’s Granta Park, while Tagomics and Trimtech Therapeutics each took 5,300 sq ft suites at Building 960 on Babraham Research Campus. The largest transaction across the Cambridge lab market in 2025 was at Abstract’s South Cambridge Science Centre, where Frontier IP signed for 18,000 sq ft in Q2.

Vacancy across Cambridge rose to 13%, almost double the level recorded at the close of 2024. This increase was driven by the delivery of speculative laboratory buildings throughout 2025, including Mission Street’s The Press Phase 2 (64,400 sq ft), Abstract’s South Cambridge Science Centre (138,000 sq ft), and Longfellow’s CamLIFE 3 (36,800 sq ft). Of the new stock delivered during the year, the only letting achieved was at the South Cambridge Science Centre.

In addition to current supply, further completions are scheduled for 2026. With the likes of CamLIFE 1 and 2 (129,500 sq ft), and the Sidney Sussex Building at Chesterford Research Park (55,600 sq ft), already completing at the start of the year, with Kadans’ Merlin Place (135,000 sq ft), and Breakthrough Properties’ Vitrum at St John’s Innovation Park (205,000 sq ft) due to complete in Q2.

Active demand stood at 377,500 sq ft at year end, with total named demand increasing to 703,000 sq ft. Active demand was up 57% year-on-year, driven by larger requirements reactivating or coming to market. Cambridge’s relative market maturity is reflected in the composition of demand, with 63% of active requirements seeking space between 10,000 and 30,000 sq ft, and a further 19% for space over 50,000 sq ft.

In the same vein, Cambridge-based companies raised £755 million of funding over the year, with 71% allocated to later-stage businesses. The average size of raise in Cambridge was also higher than in Oxford or London, at £8.4 million, compared with £7.2 million and £5.2 million respectively. Again reflecting Cambridge’s market maturity in comparison to its Golden Triangle counterparts.

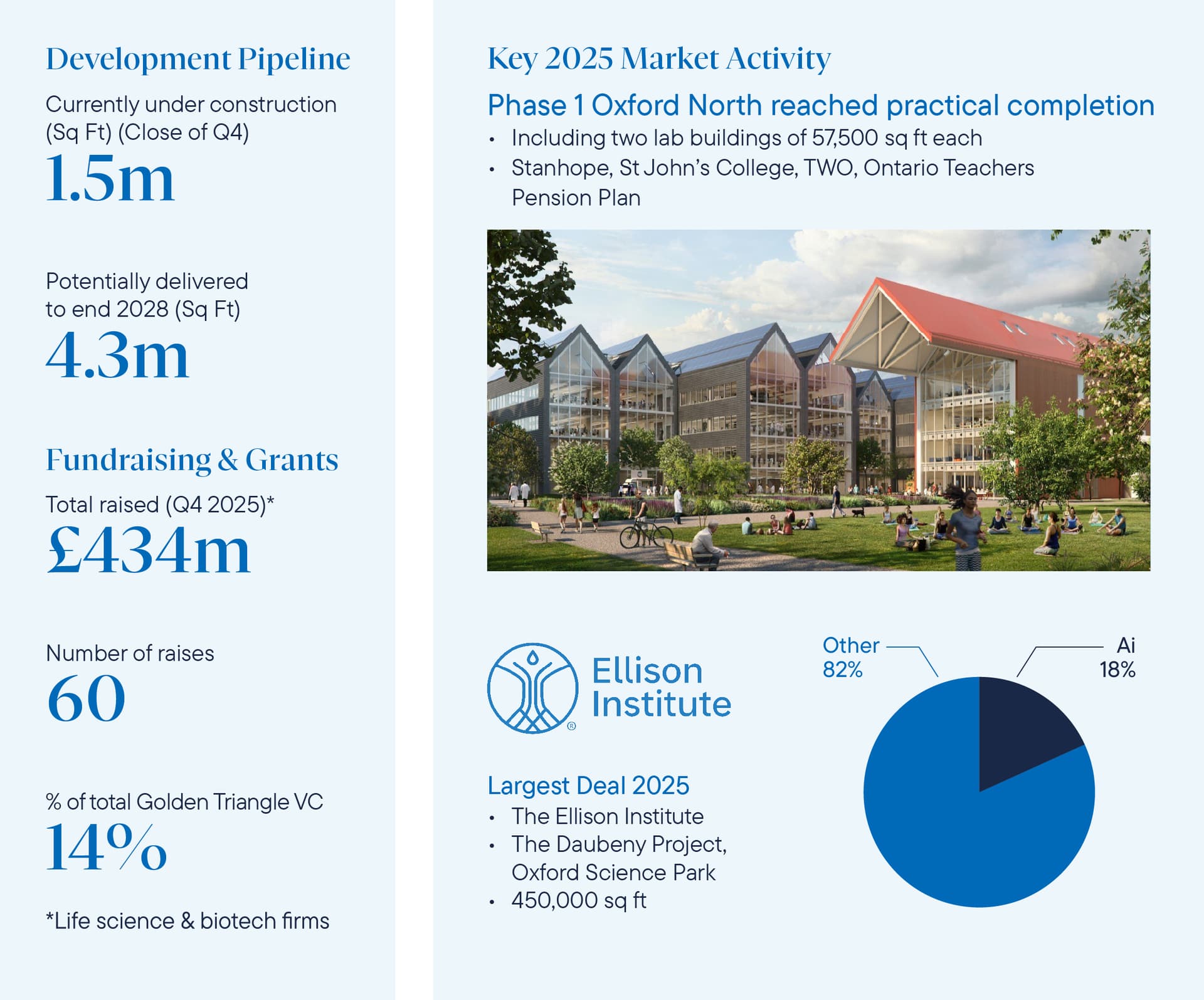

Take-up of laboratory and midtech accommodation in Oxford reached a record 615,800 sq ft, driven primarily by the Ellison Institute’s acquisition of The Daubeny Project at The Oxford Science Park. This transaction alone accounted for 450,000 sq ft of take-up, included in the Institute’s purchase of the western part of the park.

The Ellison Institute was also responsible for further activity throughout 2025, including the letting of 25,500 sq ft at the Iversen Building in Q1.

Beyond The Oxford Science Park, Kadans saw T-Cypher and Ox Devices take 11,800 sq ft at Barton House and the entirety of Monarch House (10,200 sq ft) respectively in Q4, following earlier activity in the year at Sovereign House and the Science Quadrant. In the city centre, Mission Street’s Inventa welcomed Orbit Discovery and Oxford Cancer Analytics that took 8,300 sq ft and 2,400 sq ft respectively of fully fitted laboratory space.

The headline rent of £85.50 per sq ft was achieved at The Oxford Science Park in Q1 2025, marking an increase on the previous market high of £82.50 per sq ft. Oxford continued to record the lowest availability across the Golden Triangle, with 385,100 sq ft of lab and midtech space available. The completion of Phase 1 at Stanhope’s Oxford North delivered two laboratory buildings alongside the Red Hall office building, bringing a combined 115,000 sq ft of lab space to the market, all of which currently remains available. In addition, the completion of Lumen House at Harwell in Q4 added a further 17,000 sq ft to supply.

Looking ahead to 2026, the market will see the completion of Breakthrough Properties’ Trinity House (214,000 sq ft), alongside Quad Three and Co:Labs at ARC’s Harwell, delivering 75,000 sq ft and 120,000 sq ft respectively.

Total demand reached 826,000 sq ft by year end, of which 391,000 sq ft was active. By number of active requirements, the majority of demand was for space between 10,000 and 30,000 sq ft, accounting for 41%. This was followed by demand for space under 5,000 sq ft at 24%, 12% for 5,000 to 10,000 sq ft, and 24% for space over 30,000 sq ft.

From a venture capital perspective, Oxford-based science and biotech firms raised £434 million in 2025. Whilst this remains low relative to Cambridge and London, it still represents a year-on-year increase of 4%. Funding was weighted towards later-stage venture capital, which accounted for 34% of total investment, with early-stage VC representing just 13%.